Perseverance is not a long race; it is many short races one after the other.

USD

EURUSD

The Single Currency surged to $1.1080 after the U.S. published a lower-than-expected U.S. JOLTS job openings data, boosting Federal Reserve rate cut bets.

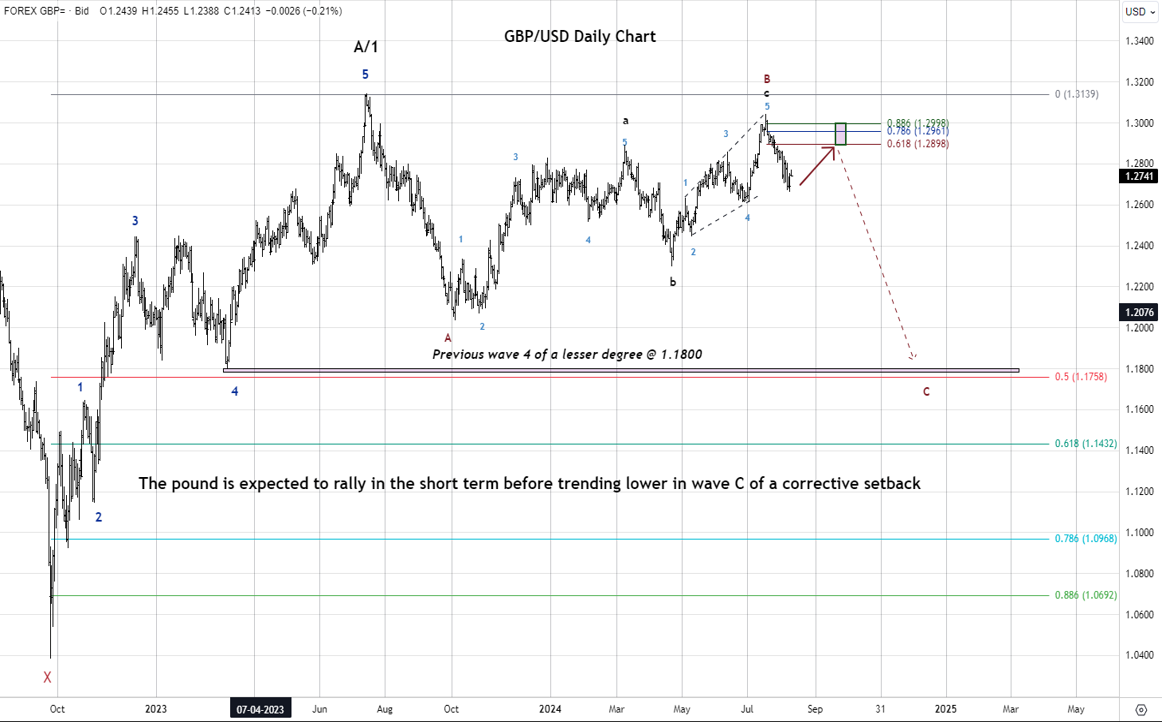

GBPUSD

The Pound Sterling jumped to $1.3150 amid an upbeat U.K. Composite and Services PMI reading.

USDJPY

The Japanese Yen shot to 143.48 against the greenback, underpinned by an overall wage income rise of Japanese employees by 3.6%.

AUDUSD

The Australian dollar climbed to $0.6723 following hawkish comments by the Reserve Bank of Australia (RBA) Governor Michele Bullock, stating that it is too early to consider rate cuts.

USDCAD

The Canadian dollar boosted to 1.3510 against its U.S. counterpart after the Bank of Canada cut interest rates by 25bps to 4.25%, as expected.

USDZAR

The South African rand strengthened to 17.87 on improved investor sentiment, as signs the domestic economy is starting to gain momentum.

USDMUR

The dollar-rupee fell by 5 cents to 46.51(selling) this morning.

16.15 USD ADP Nonfarm Employment Change.

16.30 USD Initial Jobless Claims

17.45 USD S&P Global Services PMI

18.00 USD ISM Non- Manufacturing PMI

19.00 USD Crude Oil Inventories.