Optimism is the faith that leads to achievement. Nothing can be done without hope and confidence.

USD

EURUSD

The Shared Currency steadied at $1.1057 amid a mix U.S ISM Manufacturing Purchasing Managers data.

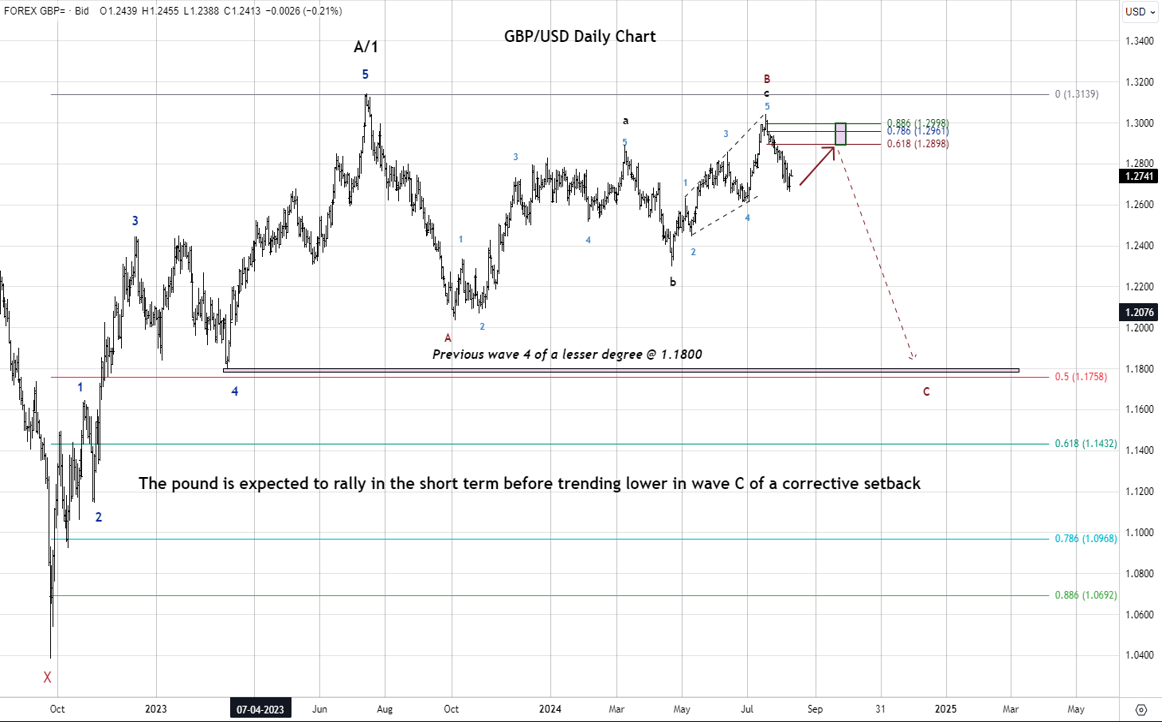

GBPUSD

The Pound Sterling eased to $1.3115 ahead of U.K Composite and Services PMI due today.

USDJPY

The Japanese Yen advanced to 145.21 against the greenback unfazed by the drop-in Japan Services PMI.

AUDUSD

The Australian dollar dipped to $0.6710 despite data showed an improvement in domestic GDP earlier today.

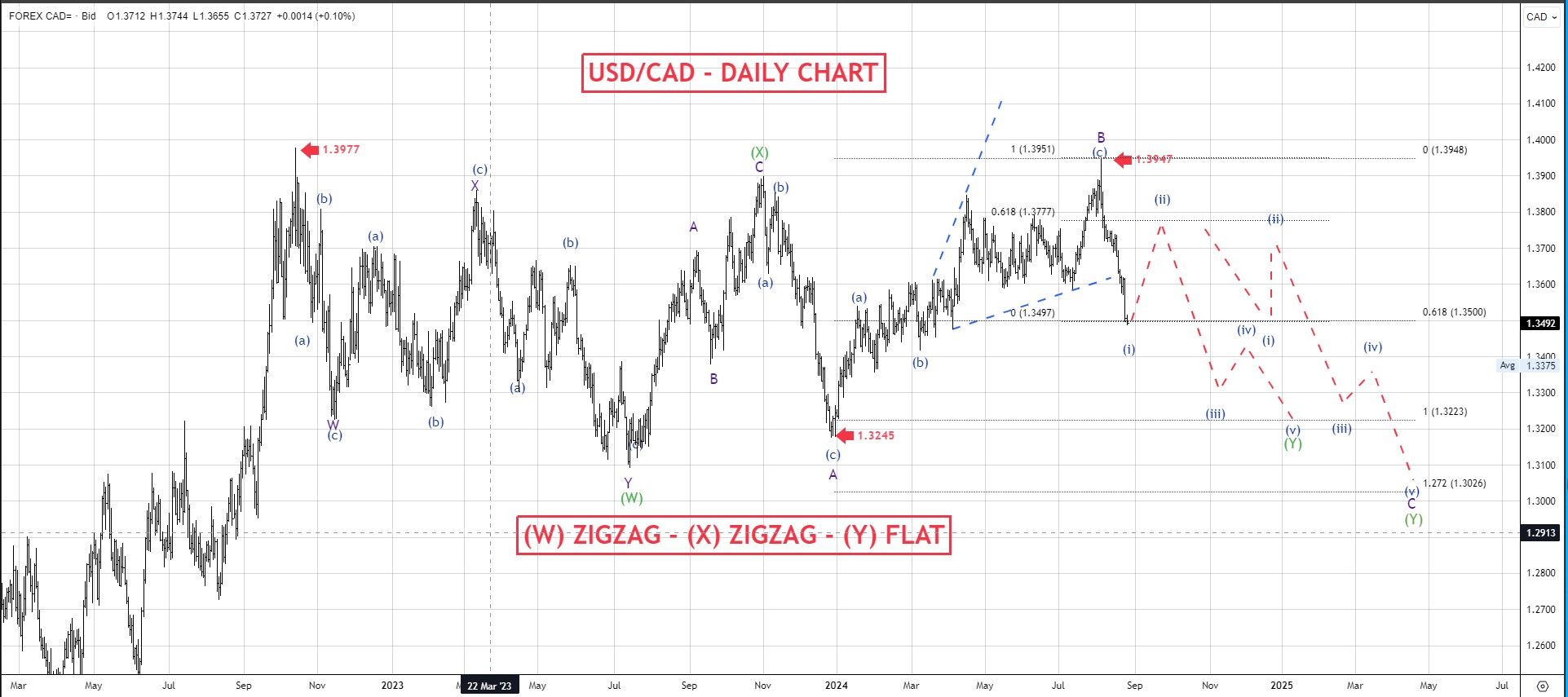

USDCAD

The Canadian dollar plopped to 1.3541 against its U.S. counterpart ahead of Canada Interest Rate Decision.

USDZAR

The South African rand crumbled to 18.02 against the U.S. dollar after domestic data showed the country's second-quarter economic growth was weaker than expected.

USDMUR

The dollar-rupee dived by 56 cents to 46.56(selling) this morning upon Bank of Mauritius intervention.

12.30 GBP S&P Global/ UK Services PMI.

17.45 CAD BoC Interest Rate Decision.

18.00 USD JOLTs Job Openings