You just can't beat the person who never gives up.

USD

EURUSD

The Shared currency edged higher to $1.1055 following a positive Eurozone Manufacturing Purchasing Managers Index (PMI).

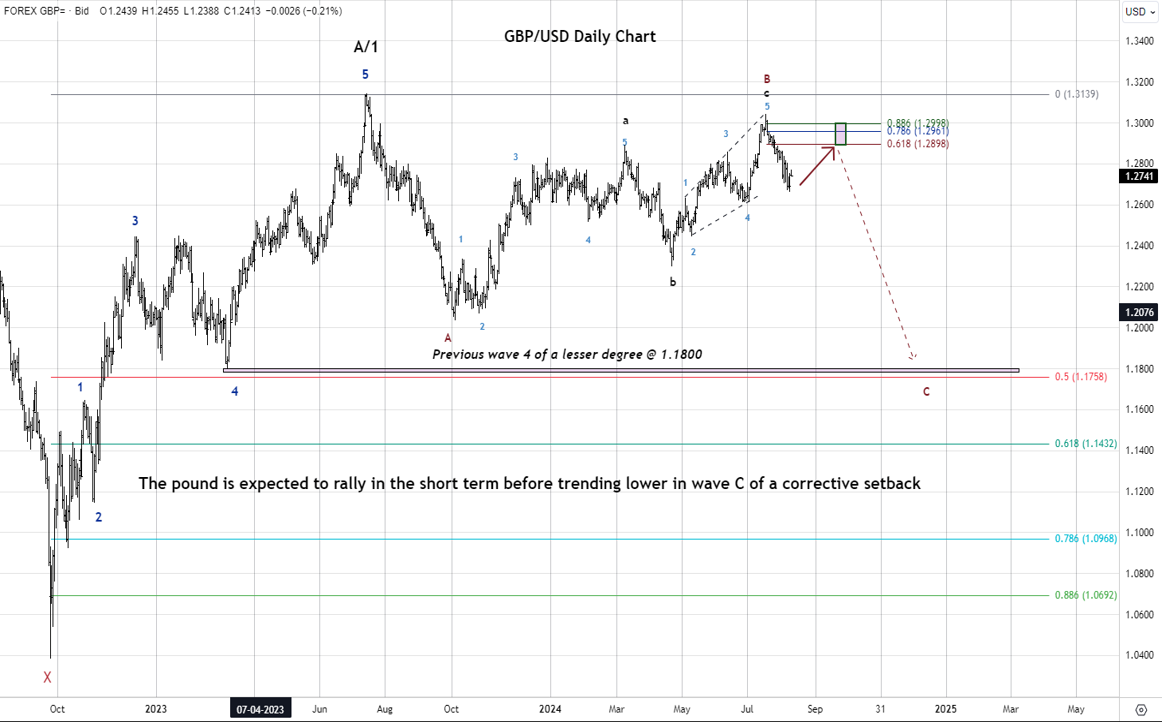

GBPUSD

The Pound Sterling is on the back foot at $1.3127 on rate cut expectations by the Bank of England for the remaining year.

USDJPY

The Japanese Yen inched up to 146.15 against the greenback underpinned by the Japanese government to allocate ¥989 billion in funding energy subsidies.

AUDUSD

The Australian dollar nosedived to $0.6737 amid a downbeat Australia Current Account to -10.7B below anticipation of -4.5B.

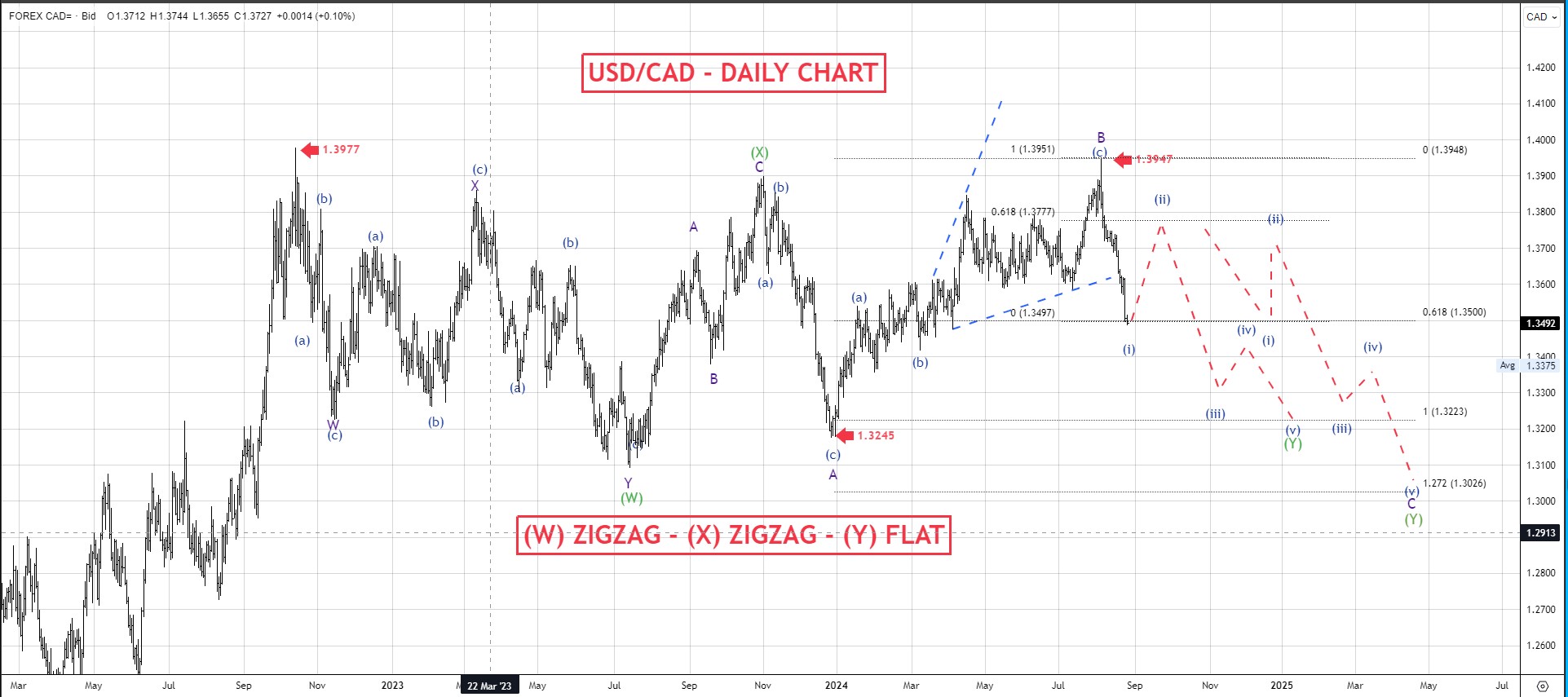

USDCAD

The Canadian dollar firmed at 1.3527 against its U.S. counterpart ahead of the U.S. Manufacturing Purchasing Managers Index (PMI) due today.

USDZAR

The South African rand meandered to 17.85 against the U.S. dollar, unbothered by a slide in South Africa Manufacturing Purchasing Index (PMI) released yesterday.

USDMUR

The dollar-rupee fell by 1 cent to 47.12(selling) this morning.

13.30 ZAR GDP (YoY)

17.45 USD S&P Global US Manufacturing PMI

18.00 USD ISM Manufacturing PMI.