Success is to be measured not by wealth, power, or fame, but by the ratio between what a man is and what he might be.

against MUR

USD

EURUSD

The Euro was back and forth at $1.1164 amid growing speculation that the European Bank will leave its Deposit Facility rate unchanged at 3.5% in its October monetary policy meeting.

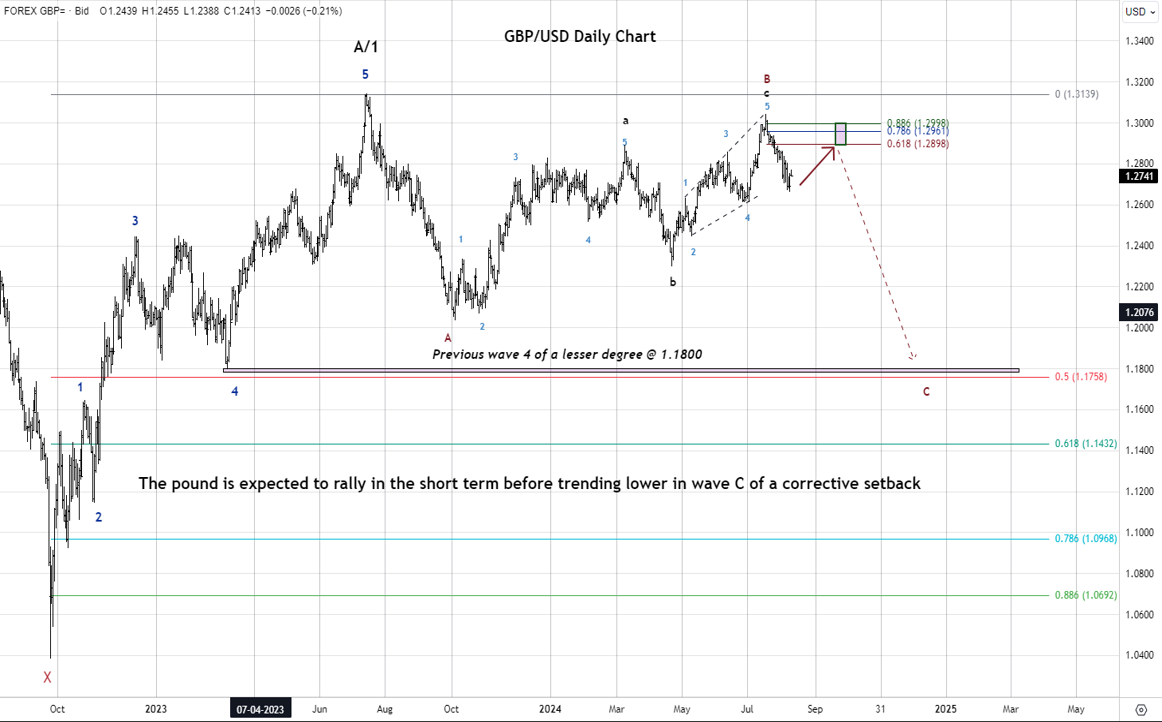

GBPUSD

The Pound Sterling plopped to $1.3314 ahead of the U.K. S&P Global Services PMI.

USDJPY

The Japanese Yen lost ground to 144.26 against the U.S. Dollar due to thin trading conditions from today's Japan Autumn holiday.

AUDUSD

The Australian dollar surged to $0.6824 as the Reserve Bank of Australia (RBA) is expected to keep the official Cash Rate steady at 4.35% tomorrow.

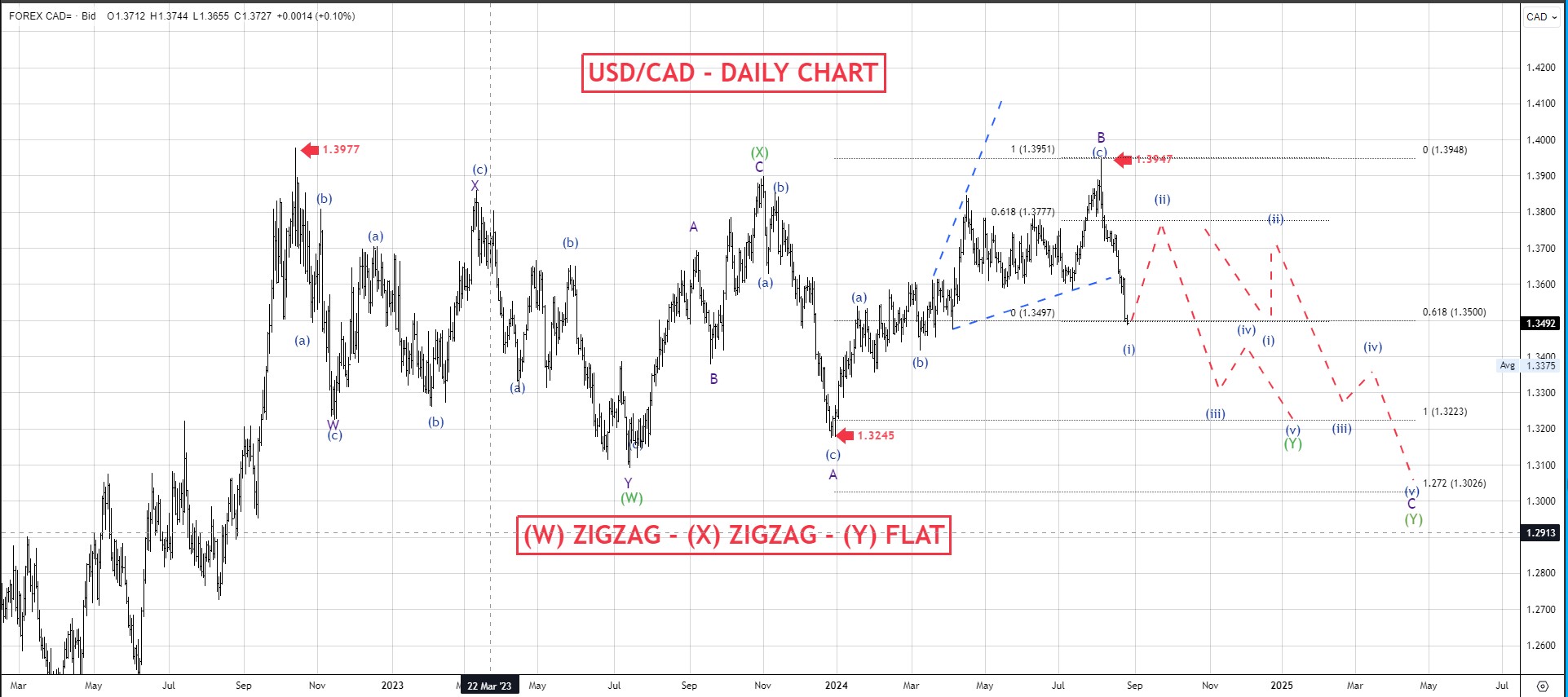

USDCAD

The Loonie unbothered at 1.3555 against the U.S. Dollar after positive Canadian Retail Sales data.

USDZAR

The South African Rand soared to 17.39 against the U.S. Dollar after interest rate cuts by the U.S. Federal Reserve and the South African Reserve Bank.

USDMUR

The dollar-rupee ran slowly to 46.25(selling) this morning.

12.30 GBP S&P Global/UK Services PMI

12.30 GBP S&P Global/UK Manufacturing PMI

16.30 CAD New Housing Price Index

17.45 USD S&P Global US Manufacturing PMI

17.45 USD S&P Global Services PMI