Success is the sum of small efforts, repeated day in and day out.

USD

EURUSD

The Euro heightened to $1.1177 after the U.S. Existing Home Sales data published a lower-than-expected reading of 3.86M versus estimates of 3.96M.

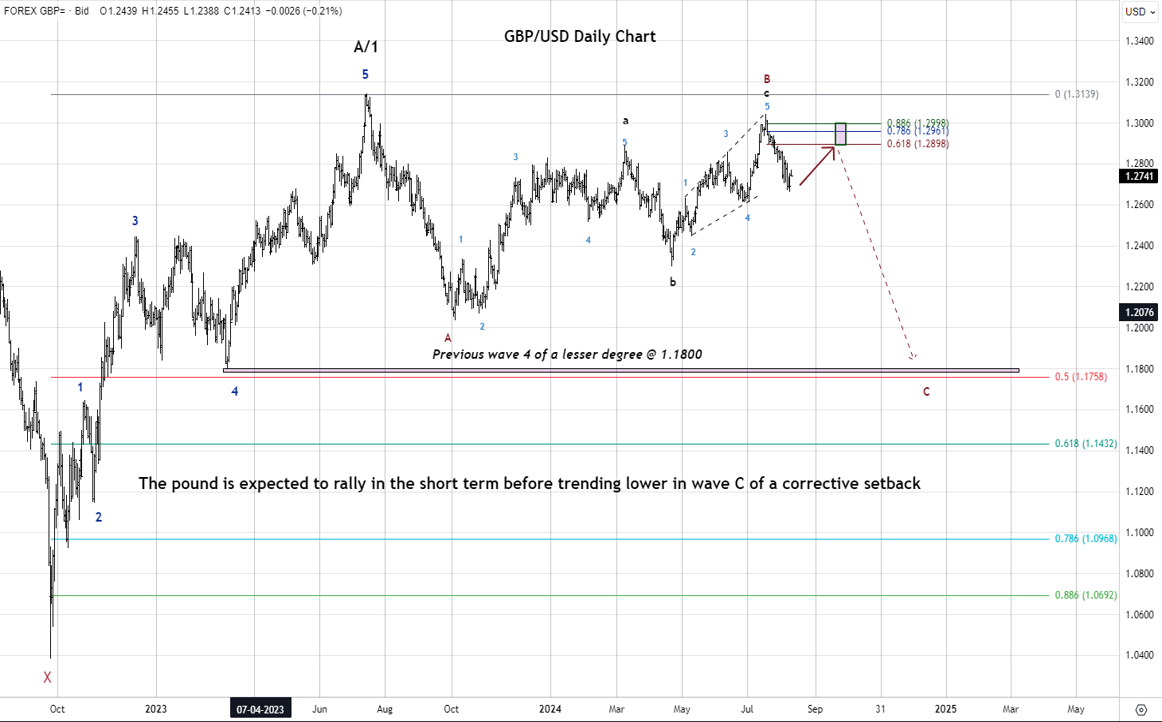

GBPUSD

The Pound Sterling rocketed to $1.3323 after the Bank of England kept the interest rate unchanged at 5% and is expected to cut the rate more slowly than the Federal Reserve. Upbeat U.K. Core Retail Sales data also underpinned the British currency.

USDJPY

The Japanese Yen remained stronger at 142.23 against the U.S. Dollar as the Bank of Japan (BoJ) kept the interest rate flat at 0.25% and mentioned that inflation and economic growth are expected to increase steadily.

AUDUSD

The Australian dollar swelled to $0.6818 on monetary policy divergence between the Reserve Bank of Australia's versus the Federal Reserve'seasing cycle.

USDCAD

The Loonie boosted to 1.3555 against the U.S. Dollar on higher crude oil prices.

USDZAR

The South African Rand seesawed at 17.50 against the U.S. Dollar following the South African Reserve Bank's decision to cut interest rates to 8% for the first time in over four years.

USDMUR

The dollar-rupee crumbed to 46.23(selling) this morning.

16.15 CAD Boc Gov Macklem Speaks

16.30 CAD Core Retail Sales

16.30 CAD New Housing Price index