Our greatest weakness lies in giving up. The most certain way to succeed is always to try just one more time.

USD

EURUSD

The Euro steadied at 1.0743 as investors look for fresh cues about when the European Central Bank (ECB) would deliver its second rate cut this year and French political uncertainty continued to keep the Shared currency on the tenterhooks

GBPUSD

The Pound eased to $1.2710 ahead of Bank of England Interest Rate Decision due today.

USDJPY

The Japanese yen receded to 158.16 against the greenback, undermined by the Bank of Japan's (BoJ) decision to hold off on any discussions around JGB tapering until the next meeting.

AUDUSD

The Aussie dollar traded in positive territory for the third consecutive day today at $0.6670 on hawkish stance from the Reserve Bank of Australia (RBA) at its June meeting on Tuesday continues to support the pair.

USDCAD

The Canadian dollar back and forth at $1.3718 as U.S markets were shuttered yesterday for Juneteenth holiday, thinning out market volumes.

USDZAR

The Rand propelled to 17.96 against the U.S Dollar following the release of local inflation figures and the inauguration of President Cyril Ramaphosa for a second term.

USDMUR

The dollar-rupee stabilized at 47.33(selling) this morning.

15.00 GBP BoE Interest Rate Decision

16.30 USD Initial Jobless Claims

16.30 USD Philadelphia Fed Manufacturing

19.00 USD Crude Oil Inventories

As expected, the EUR/USD has been on a steep uptrend since September 2022 on hawkish ECB.

Elliott wave pattern

Daily Chart

A Clear impulsive 5-wave structure from a low of $0.9534 to a high of $ 1.1035 in February 2023

Possible Expanding Diagonal in wave c of wave b of a flat correction

Forecast

Short term

We expect a corrective setback in wave C in the coming month

1st target 1.1.0670 Wave a =Wave C of a flat correction

2nd Target 1.0530- Wave a =127.2% of wave C of a flat correction

Long term

Once the pullback is completed, we might see the EUR/USD jumping out of the block to $1.1560, followed by $1.2000 by year-end of 2023

News

The USD/MUR suddenly burst to a new high at 47.48 in March, driven by FX liquidity concerns, before BOM stepped in to smooth the excessive volatility and injected USD 30 mio on the domestic market.

The USD/MUR fell sharply to 45.40 in the wake of three interventions of the Bank of Mauritius from March 2023 to date.

Elliott wave pattern- Weekly Chart

Double zig-zag upward correction in wave W-X-Y, since 2000 completed!

Bearish turn ahead!

Clear 5-wave structure in wave 5 of wave C of wave (Y)

Over the last four years, the USD/MUR surged by 42% from a low of 32.90 in wave 4 to reach an all-time high of 47.47 on 16th of March 2023, before falling back to 45.40 in an impulsive decline from Mid-March to late April 2023

Forecast- USD/MUR on the brink of a downturn in Q2-Q4 of 2023

On the weekly USD/MUR chart, It seems that the pair may have completed a five-wave upward rally in sub-wave (v) of Wave 5 of Wave C of Wave Y with a peak of 47.47 on the 16th of March

Our Short term target is for a downward trend towards 44.00 followed by 43.00 in December 2023

Forecast

EUR/MUR- On the weekly chart, the EUR/MUR may extend its rally in the short term above the high of 51.05 printed in July 2021.

From a technical perspective, on a break of the previous high at 51.05, the pair may find resistance at 52.00, followed by 52.50 by June 2023.

However, we expected the pair to pare some of its gains to 48.50 by September 2023 before a resumption of the uptrend to 53.40-54.50 by December 2023

The Pound Sterling is experiencing a lot of selling pressure against the U.S. dollar due to the ongoing risk aversion theme. The Bank of England's aggressive monetary policy tightening is also causing concern for the U.K. economy, as it may not pause the policy tightening spell in time.

Additionally, Britain's Consumer Price Index (CPI) is currently the highest among G7 economies, which may require more rate hikes in the future. However, UK Finance Minister Jeremy Hunt has reassured the public that the administration is working to bring inflation down to almost 5% by year-end.

From a technical standpoint, the GBP/USD is still trapped in a Triple Zig-Zag Correction on the Hourly Chart. This could potentially lead to the pound reaching new lows in the coming sessions/days.

The downside targets are as follows:

- Target 1 @ 1.2487

- Target 2 @1.2418

- Target 3 @ 1,2330

On the flip side, if the pound were to move back to $1.2641 and 1.2710, it would invalidate the bearish count!

News

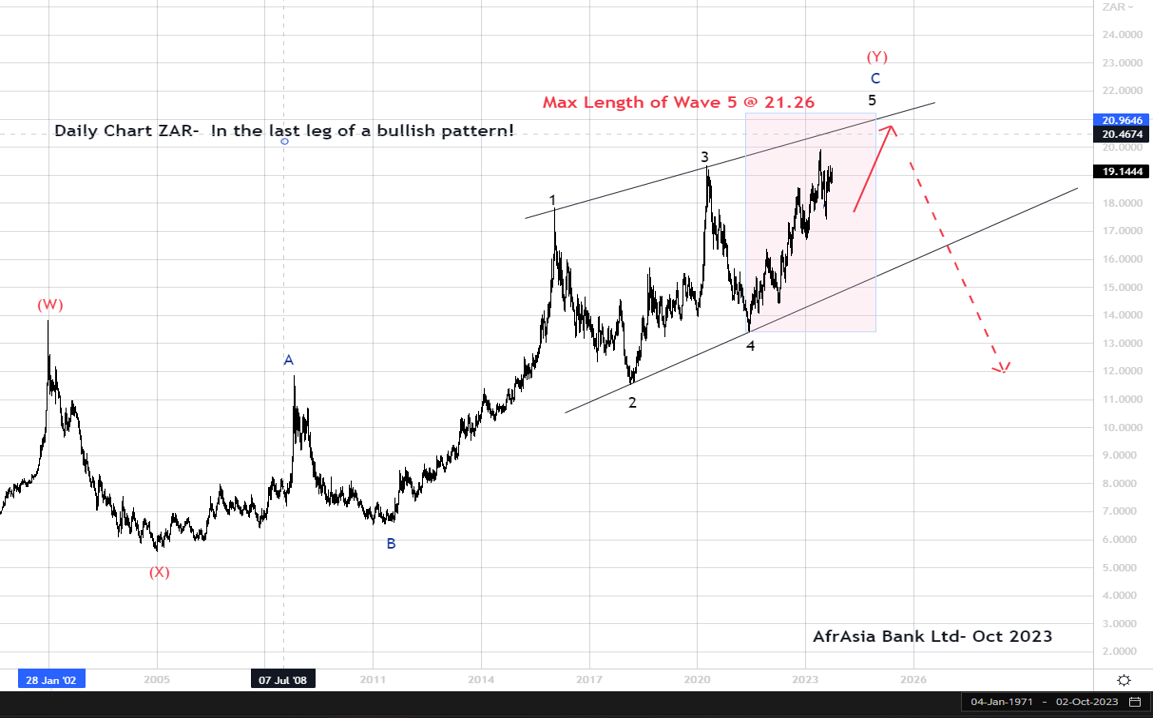

The Rand has experienced a 10.3% decrease against the U.S. dollar in Q3 of 2023. This is due to a less optimistic economic outlook, which has been impacted by the Eskom power supply issues in South Africa.

Technical Outlook

A Diagonal pattern in wave C of wave (Y) is still underway.

Looking at the Elliott wave pattern, the USD/ZAR Daily Chart reveals a Diagonal pattern in wave C of wave (Y) is still in progress. The overall pattern from January 2011 to October 2023 appears to be forming a Clear 5-wave motive

structure (Diagonal) in wave C of wave (Y).

Forecast

We anticipate the USD/ZAR to gradually increase to a maximum of 21.26 in the upcoming months before reversing in the first quarter of 2024.

1st target 19.92- high of May 2023

2nd Target 20.65- upper trendline connecting wave 1-3

3rd Target 21.26- Maximum length of Wave 5 of wave C