Life is 10% what happens to you and 90% how you react to it.

USD

EURUSD

The Euro boomeranged to $1.1120 this morning, off yesterday's high at $1.1189, as the dust settled around the much anticipated 50 basis points rate cut by the Federal Reserve.

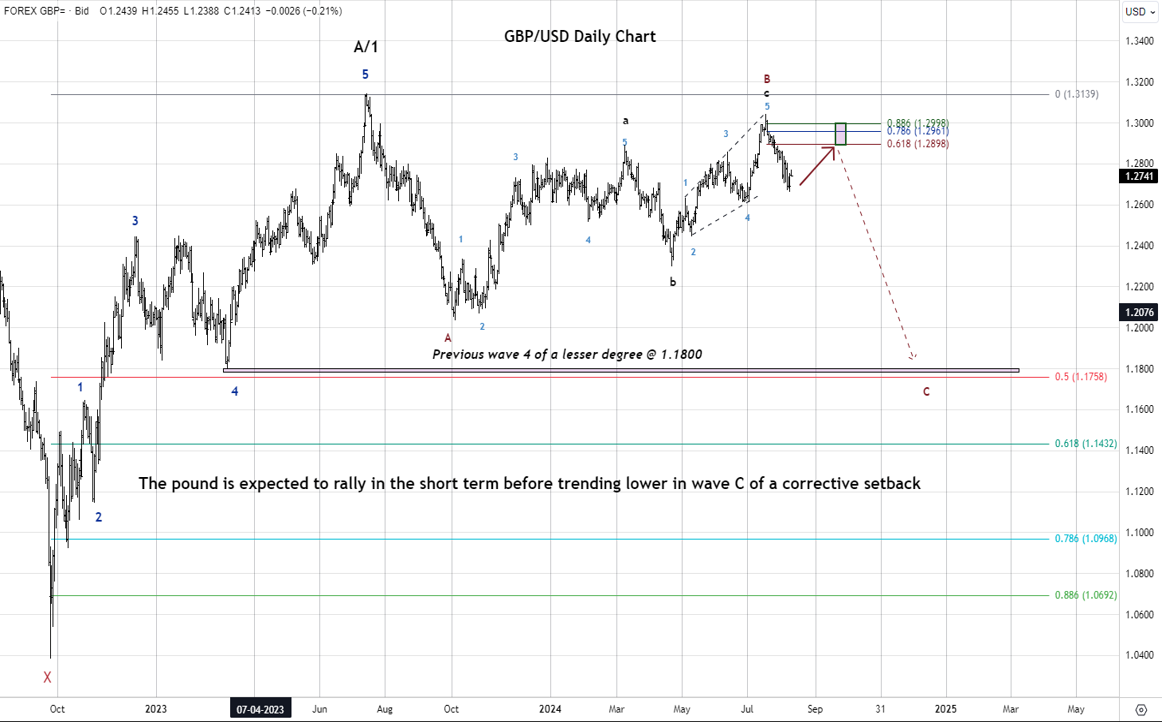

GBPUSD

The Pound Sterling jumped to $1.3214 as Bank of England's interest rate decision looms, with little expectations that they will cut today.

USDJPY

The Japanese Yen collapsed to 143.00 against the U.S. Dollar as Fed Chair, Jerome Powell, emphasized that last night's jumbo rate cut is not the "new pace".

AUDUSD

The Australian dollar cheered positive employment figures, crawled higher at $0.6795.

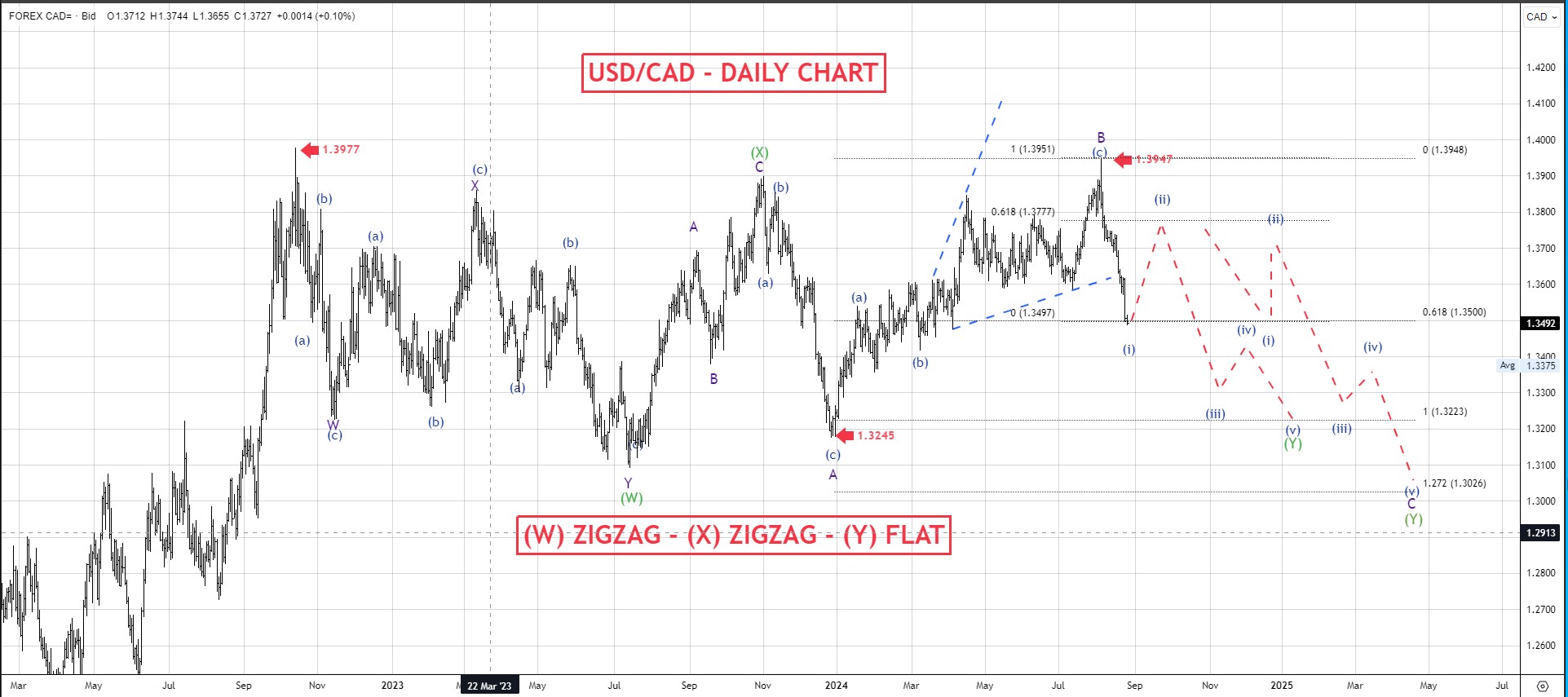

USDCAD

The Loonie was unfazed at 1.3595 against the U.S. Dollar as money markets are also pricing a 50 basis points rate cut by the Bank of Canada in October.

USDZAR

The South African Rand strengthen further at 17.50 against the U.S. Dollar as the South African Reserve Bank will decide on their reference rate today.

USDMUR

The dollar-rupee climbed to 46.35(selling) this morning.

10:00 GBP Consumer Prices

13:00 EUR Core Harmonized Index of Consumer Prices

15:00 EUR German Buba President Nagel speech

16:30 USD Building Permits

21:30 CAD BoC Summary of Deliberations

22:00 USD Fed Interest Rates Decision

22:00 USD Fed Monetary Policy Statement

22:30 USD FOMC Press Conference