Never give up, for that is just the place and time that the tide will turn.

USD

EURUSD

The Single currency backpedaled to $1.1120 after a brief visit post the $1.1140 level ahead of the Eurozone's core harmonized consumer prices today.

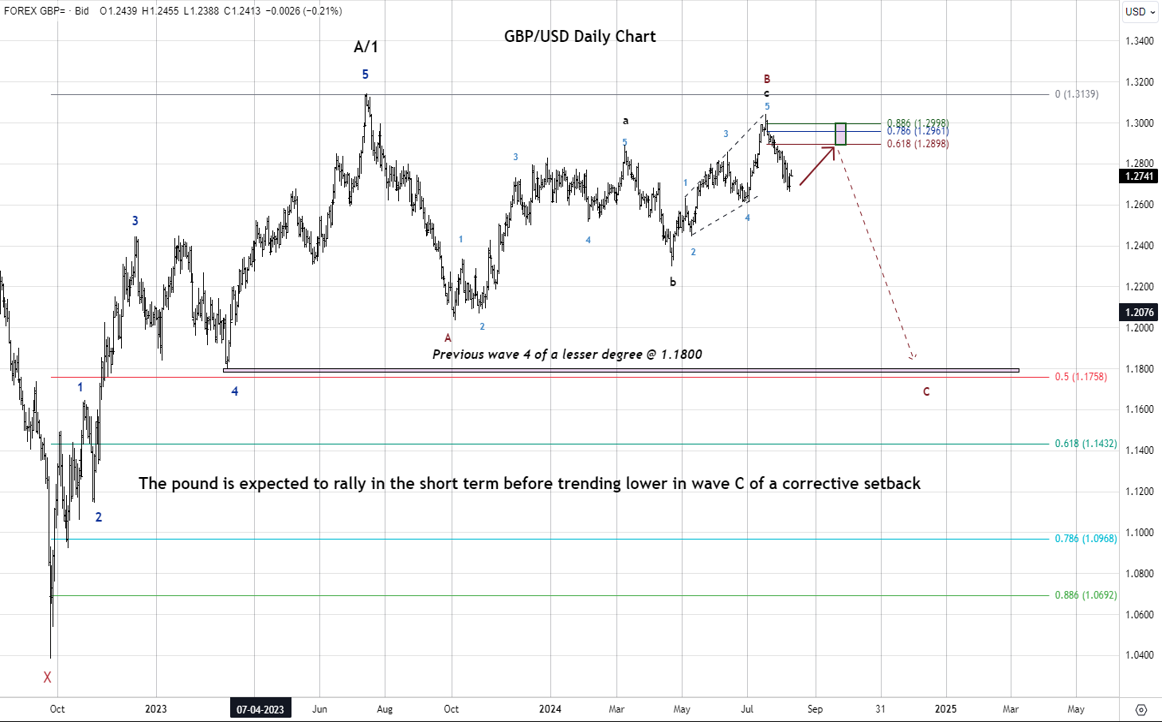

GBPUSD

The Pound Sterling plummeted to $1.3155 as market participants await British consumer prices due this morning.

USDJPY

The Japanese Yen jumped to 141.35 against the greenback this morning after sustaining significant losses to 142.45 ahead of U.S. Interest Rates Decision and Monetary Policy Statement.

AUDUSD

The Australian dollar firmed at $0.6755, with no domestic data expected until the employment figures due tomorrow morning.

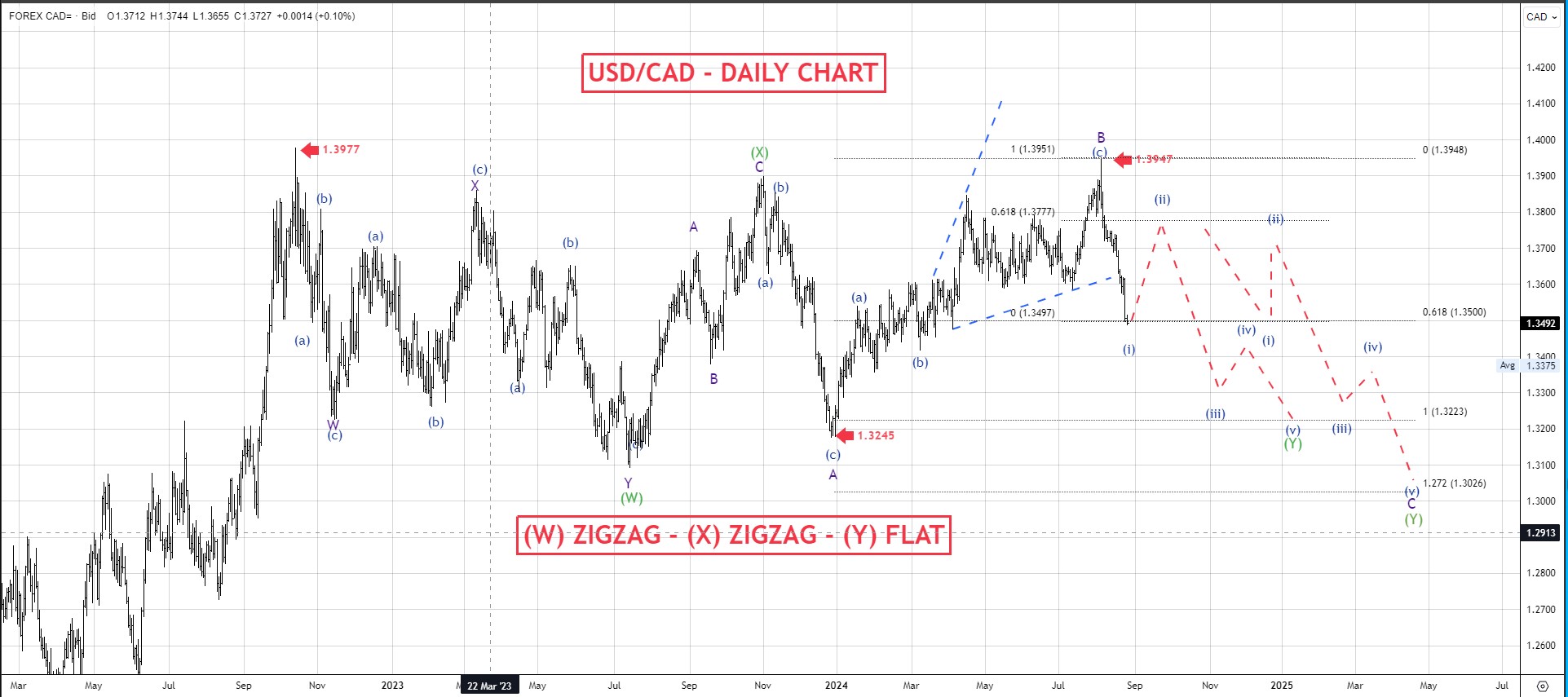

USDCAD

The Loonie stable at 1.3590 against the U.S. Dollar as bets for a jumbo Fed rate cut coincided with falling oil prices, a Canadian main export.

USDZAR

The South African Rand marched to a 5-day winning streak at 17.59 against the greenback, with the South African Reserve Bank expected to cut their interest rates on Thursday to 8%, making it still significantly higher than that of the United States.

USDMUR

The dollar-rupee stayed put at 46.30(selling) this morning.

10:00 GBP Consumer Prices

13:00 EUR Core Harmonized Index of Consumer Prices

15:00 EUR German Buba President Nagel speech

16:30 USD Building Permits

21:30 CAD BoC Summary of Deliberations

22:00 USD Fed Interest Rates Decision

22:00 USD Fed Monetary Policy Statement

22:30 USD FOMC Press Conference