Perseverance is failing 19 times and succeeding the 20th.

USD

EURUSD

The Euro sailed higher to $1.1100 after the Eurozone Industrial Production data published a higher- than expected reading, markets awaits the Federal Reserve meeting where the central bank is likely to cut interest rates this Wednesday.

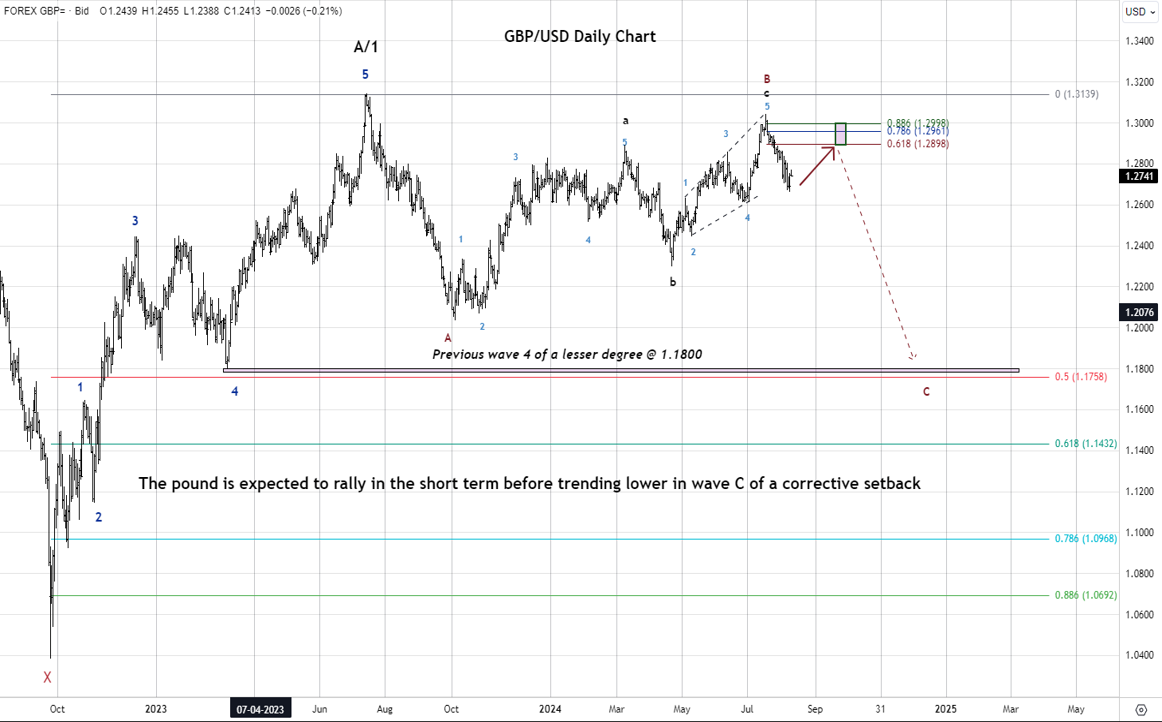

GBPUSD

The Pound Sterling ticked up to $1.3155 despite markets are betting on more Bank of England (BoE) rate cuts after U.K data released last week pointed to a slowdown in the U.K wage growth.

USDJPY

The Japanese Yen propelled to 140.14 against the U.S. dollar amid anticipation that the Bank of Japan Interest rate decision on this Friday would provide a hawkish outlook for interest rates.

AUDUSD

The Australian dollar hopped to $0.6725 unfazed by the rise in China's Unemployment Rate to 5.3% which is Australia's main trading partner.

USDCAD

The Canadian dollar ran slowly to 1.3567 against its U.S. counterpart on upbeat Canada Wholesale data.

USDZAR

The South African Rand surged to 17.69 against the greenback underpinned to a rising odds of an aggressive rate cut by the Federal Reserve.

USDMUR

The dollar-rupee fell by 5 cents to 46.35(selling) this morning.

13.00 EUR Wages in Euro Zone

13.00 EUR Trade Balance

16.00 EUR ECB's Lane Speaks

16.30 USD NY Empire State Manufacturing Index.