Do not wait to strike till the iron is hot; but make it hot by striking.

USD

EURUSD

The Euro surged to $1.1084 after the European Central Bank (ECB) lowered its key borrowing rates by 0.25 basis points, as expected. President Christine Lagarde did not provide hints for further rate cuts.

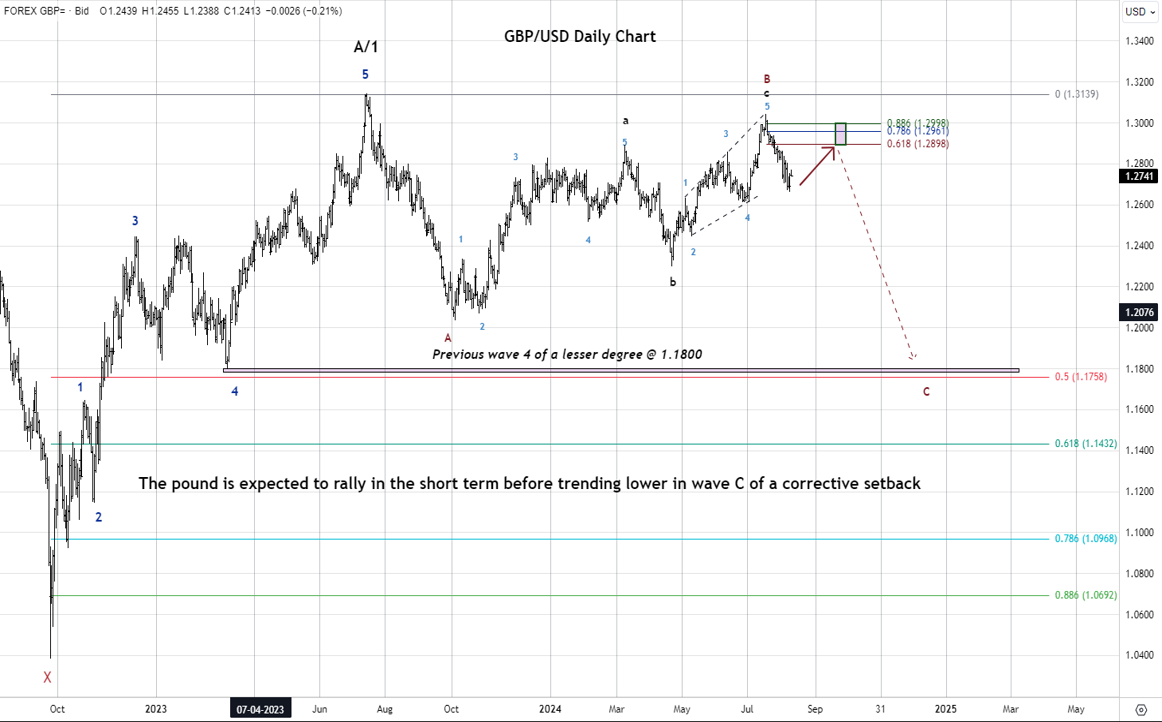

GBPUSD

The Pound Sterling rallied to $1.3145 ahead of the BoE meeting next week, where markets anticipate the central bank to hold rates after a 25 basis point rate cut in August.

USDJPY

The Japanese Yen hoisted to 140.90 against the U.S. dollar after Fitch Ratings mentioned in its latest report that the Bank of Japan (BoJ) could hike the rate to 0.5% by the end of 2024.

AUDUSD

The Australian dollar held gains to $0.6722 amid rising odds of a jumbo rate cut by the Federal Reserve next week after softer U.S. initial jobless claims.

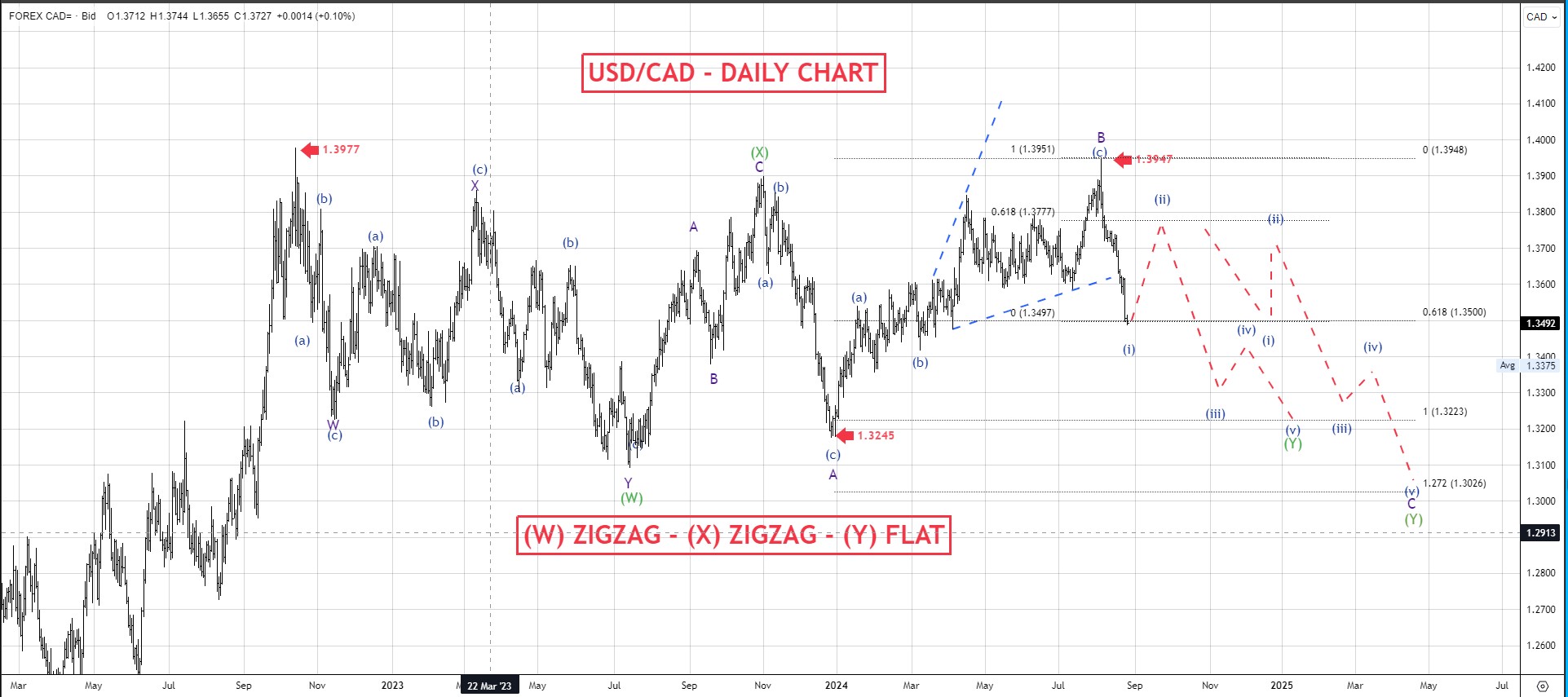

USDCAD

The Canadian dollar drifted below 1.3578 against its U.S. counterpart on upbeat Canada Building Permits data of 22.1%, above anticipation of 6.5%.

USDZAR

The South African Rand boosted to 17.75 against the greenback following an improvement in South Africa mining Production data.

USDMUR

The dollar-rupee faded by 20 cents to 46.40(selling) this morning.

13.00 EUR Industrial Production.

14.00 Euro Eurogroup Meetings.

16.30 USD Export Price Index

16.30 USD Import Price Index

16.30 CAD Wholesale Sales