Every time you get angry, you poison your own system.

USD

EURUSD

The Euro hopped to $1.1050 ahead of U.S. inflation data scheduled this afternoon.

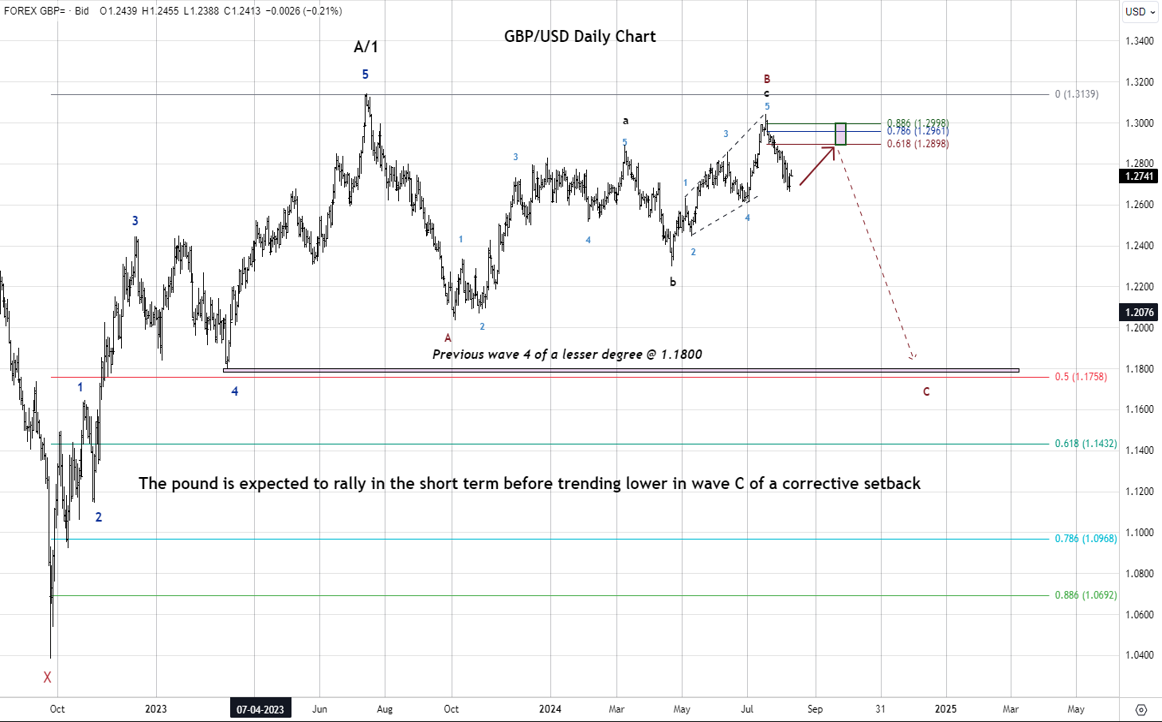

GBPUSD

The Pound Sterling rose to $1.3098 despite U.K. GDP sliding to 0% in July versus 0.2% below estimates.

USDJPY

The Japanese Yen reached its highest level of the year at 140.70 against the U.S. dollar following a speech by Bank of Japan board member Junko Nakagawa, who reiterated the central bank's commitment to raising interest rates if the economy and inflation align with its forecasts.

AUDUSD

The Australian dollar weakened to $0.6655 after Australia's Consumer and Business sentiment continued to deteriorate, dragging down the Aussie.

USDCAD

The Canadian dollar faltered to 1.3596 against its U.S. counterpart on dovish comments from Bank of Canada (BoC) Governor Tiff Macklem, stating that deeper rate cuts could be appropriate.

USDZAR

The South African subsided to 17.90 against the greenback, unfazed by an uptick in South African manufacturing data.

USDMUR

The dollar-rupee opened flat at 46.50(selling) this morning.

16.30 USD Core CPI

18.00 EUR German Buba Vice President Buch Speaks.

18.30 USD Crude oil Inventories