The market is a device for transferring money from the impatient to the patient.

USD

EUR/USD

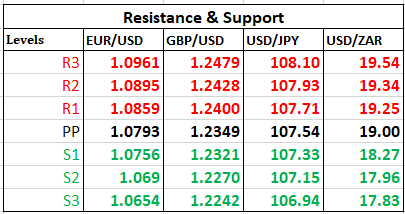

The single currency recovered to $1.0853, having hit one-month low of $1.0725 on Friday, ahead of the U.S Fed's monetary policy decision due on Wednesday, followed by the ECB's review the next day.

GBP/USD

The cable surged to $1.2445 as PM Johnson is back in Downing street after recovering from COVID-19 and is expected to announce plans for easing a month-old lockdown as early as this week.

USD/JPY

The yen rocketed to 107.20 against the US dollar after the Bank of Japan removed limits on its government bond purchases and increased corporate debt buying to help companies hit by the coronavirus crisis.

AUD/USD

The Aussie vaulted to $0.6470 on report that more than a million Australians rushed to download an app designed to help medical workers and state governments trace close contacts of COVID-19 patients, as Prime Minister Scott Morrison's approval rating soared on his pandemic response.

USD/ZAR

The South African rand edged higher to 18.93 per dollar as markets cheered President Cyril Ramaphosa’s move to open parts of the economy next month at the end of a five-week lockdown, and remains close for today.

USD/MUR

The pair idled to 40.40(selling) on the domestic market.

- From an Elliott Wave standpoint, USDCHF could potentially unfold into compelling impulsive Wave C of the zigzag correction of Wave (2) to a narrowing region 0.9550 (50% retracement of Wave (1)) to 0.9395 (100% projection of Wave A through B) in the near term trend, from the downside bias from April 6th high of 0.9797.

- Price could immediately start to shoot back up into Wave (3) on a longer perspective.

- Piercing above the resistance 0.9905 would endorse the structure.

- Alternatively, broader bearish invalidation of Elliott Wave Structure rest at 0.9191 of March 9th low while Relative Strength Index signals a bullish recoil higher for the pair.

• After rallying to the downside from a high of 112.22 to 101.17 amid global pandemic threat, USD/JPY has been in a correcting mode since 9th March 2020 and seemed to have recently completed an W-X-Y Double Zig-Zag structure of Wave (2) reaching a high of 111.64 on 27th March 2020.

• Two strong indicators were flashing a trend reversal: ending diagonal at Wave 5 of Wave c and bearish RSI divergence.

• On the hourly chart, as per Elliott Wave analysis, the pair might resume its downwards trend targeting 100.64 - 93.78 to unfold Wave (3), a projection of 100%-161.8% of Fibonacci level.

• At 107.70 today, USD/JPY is percolating towards its target from 110.41 to 107.84, as per chart.

• On a side note, resumption of a bullish USD/JPY would mark an invalidation of the Elliott Wave structure above 112.22