Attitude is a little thing that makes a big difference.

USD

EUR/USD

The Euro remained subdued at around $1.1808 as market await US PPI inflation data this afternoon, while the drop in Eurozone inflation to its lowest since September 2024 helps offset US tariff uncertainty.

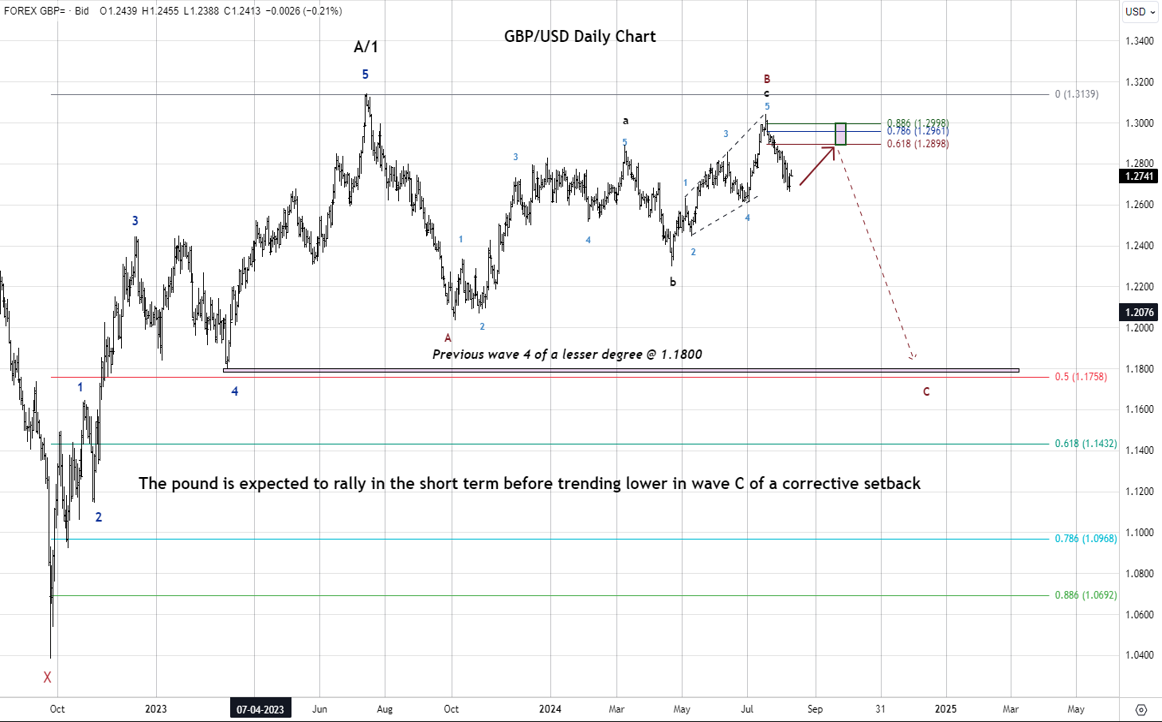

GBP/USD

The Pound Sterling sank to $1.3492 amid growing political uncertainty in the UK.

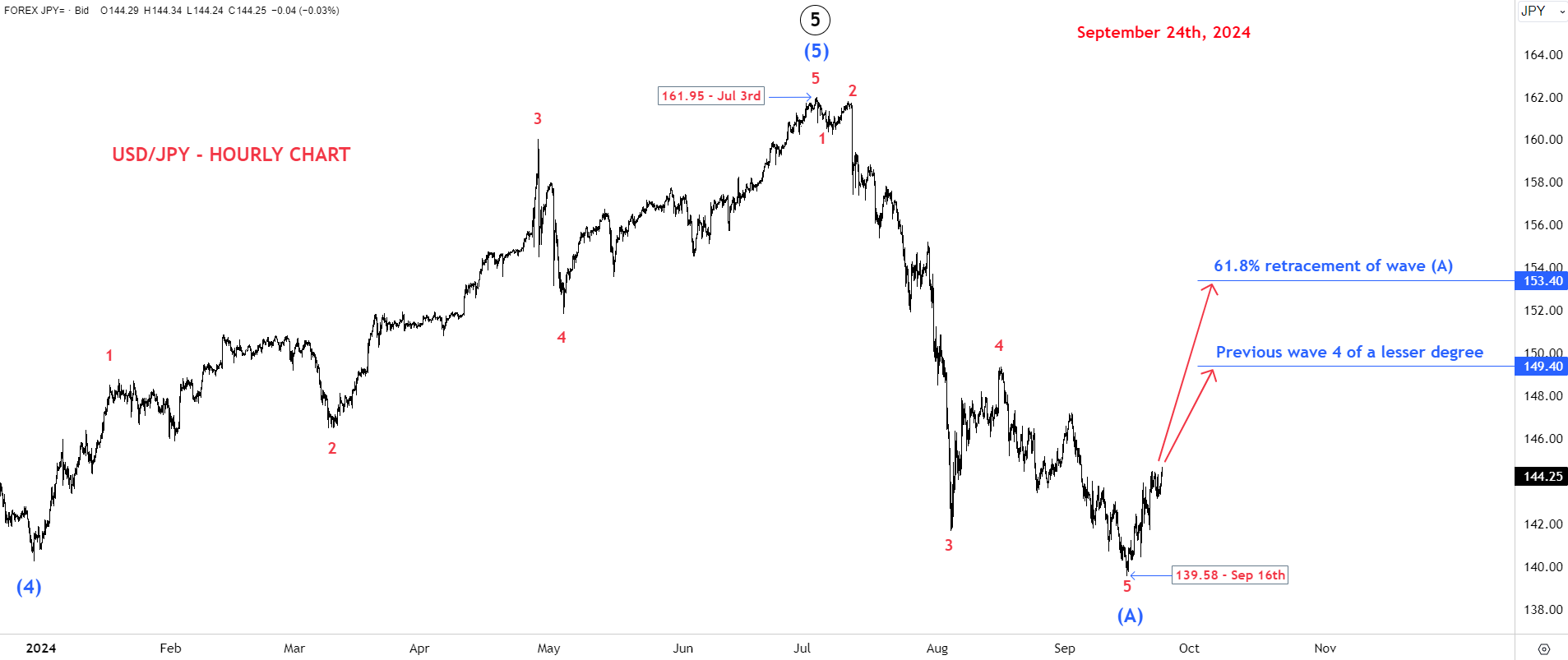

USD/JPY

USD/CAD

The Canadian Dollar was steady at 1.3665 against its U.S. counterpart ahead of Canada’s Q4 GDP data due later today.

USD/ZAR

The South African Rand consolidated to 15.9059 against the U.S. dollar, after the S.A government presented its annual budget, showcasing stable sentiment and fiscal stability.

USD/MUR

The Dollar-Rupee gained 5 cents to 46.84 (selling) this morning.

11:00 AM CHF Gross Domestic Product (QoQ) (Q4)

11:00 AM CHF Gross Domestic Product (YoY) (Q4)

12:00 PM EUR Harmonized Index of Consumer Prices (YoY) (Feb) Prel

12:55 PM EUR Unemployment Change (Jan)

12:55 PM EUR Unemployment Rate s.a. (Jan)

5:00 PM EUR Consumer Price Index (MoM) (Feb) Prel

5:00 PM EUR Consumer Price Index (YoY) (Feb) Prel

5:00 PM EUR Harmonized Index of Consumer Prices (MoM) (Feb) Prel

5:00 PM EUR Harmonized Index of Consumer Prices (YoY) (Feb) Prel

5:00 PM GBP BoE's Pill speech

5:30 PM CAD Gross Domestic Product (MoM) (Dec)

5:30 PM CAD Gross Domestic Product (QoQ) (Q4)

5:30 PM CAD Gross Domestic Product Annualized (Q4)

5:30 PM USD Producer Price Index (MoM) (Jan)

5:30 PM USD Producer Price Index (YoY) (Jan)

5:30 PM USD Producer Price Index ex Food & Energy (MoM) (Jan)

5:30 PM USD Producer Price Index ex Food & Energy (YoY) (Jan)

6:45 PM USD Chicago PMI (Feb)

8:30 PM EUR ECB's Kocher speech