In your role overseeing global business, how do you perceive the unique characteristics and strategies of the Mauritian financial services sector, especially in comparison to other global financial hubs?

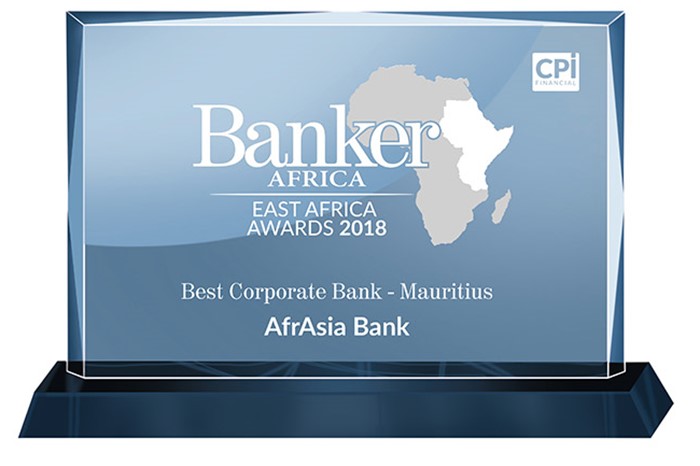

For the past three decades, Mauritius has consistently held its status as one of the most distinguished International Financial Centers (IFCs), drawing increasing interest from African investors, family businesses, multinationals, and High Net Worth Individuals. The country's popularity is on the rise, even as it remains dedicated to a robust regulatory framework aligned with international standards set by organizations like FATF, EU, ESAAMLG, OECD, among others. Mauritius holds a strategic advantage in the global financial landscape due to its geographical positioning and a workforce proficient in both English and French. This positions Mauritius favorably among other IFCs as it effectively acts as a bridge connecting Africa and Asia. The country also boasts a sophisticated economy, a resilient financial system, solid regulatory structures, political stability, a well-footed banking sector, and numerous double taxation avoidance treaties with various countries. With zero exchange control regulations, Mauritius emerges as a preferred jurisdiction for businesses and an ideal platform for structuring investment funds, fund managers, and advisors. Moreover, the country holds the top rank in ease of doing business in Africa.

From a sector-wide perspective, what innovative trends or technological advancements are shaping the future of banking and finance in Mauritius, particularly in catering to the international market?

The Government and the private sector are closely collaborating to position Mauritius as a significant player, empowering players on the ground to support innovative services like the Variable Capital Company. This structural innovation places Mauritius on par with other globally recognised jurisdictions in technological development, a crucial factor for sustaining high flows of foreign direct investment. Last year, the International Monetary Fund underscored the importance of Special Purpose Vehicles (SPVs) in channeling substantial fund flows. In alignment with the prevailing trend towards going cashless, the Government amended relevant legislations in 2022 to accommodate cashless transactions, with the Virtual Asset and Initial Token Offerings Services Act 2021 coming into effect in 2022. The banking sector is innovating in line with the international market, providing options such as tap-to-pay cards, hassle-free e-transfers completed with a few clicks, and various cashless payment methods through relevant mobile applications. Taking a broader perspective, it won't be long before Mauritius aligns itself with its international counterparts. Meanwhile, ongoing efforts to uplift talents and the establishment of a FinTech hub, coupled with the expanded use of Artificial Intelligence are poised to act as catalysts in shaping the future of banking and finance, particularly in the global financial markets, in Mauritius.

Considering Mauritius’s strategic geographic position, how do you see the broader financial sector leveraging this for enhancing cross-border transactions and investments between Africa and Asia?

Mauritius strategically bridges Africa and Asia, leveraging its advantageous geographical position and aligned time zone. The continent's increasing focus on trade financing, compounded by the recognized USD 100 million African Trade Finance Gap, positions Mauritius to play a pivotal role. Despite its size, Mauritius possesses the expertise to address this gap, providing crucial trade financing to businesses across Africa. With zero exchange control regulations, Mauritius can facilitate seamless transactions in foreign currencies, including various African and Asian currencies. Its robust banking system serves as an ideal platform for Private Equity funds, and Mauritius is a preferred destination for Development Financial Institutions, offering a reliable regulatory framework. In proximity to the African continent, Mauritius acts as a gateway to all 54 countries. Recognizing the rise of Mauritius, World Bank's Global Economic Prospect report for 2023 identifies the island among the top 10 countries with the highest economic prospects.

With the growing emphasis on sustainable and ESG-compliant practices, what significant shifts or initiatives are you observing within the Mauritian financial sector towards green and sustainable finance?

The Mauritius IFC strategically emphasizes Environmental, Social, and Governance impact, Green Finance, and Sustainable Finance. The rapidly evolving international ESG-related regulatory landscape is influencing local initiatives, including mandatory ESG disclosures for financial institutions in Mauritius. These regulatory shifts assist local institutions in aligning with global green strategies and meeting investor demands for transparency. The challenge lies in adapting regulations and tailoring sustainable finance taxonomies to the local context while allowing flexibility to accommodate foreign investment. A study by Capital Economics found that 9% (USD 82 billion) of investment flowed through Mauritius. With Africa requiring USD 350 billion for SDG-aligned projects, Mauritius plays a vital role in driving impactful investment.

In the context of the Mauritius International Finance Center and the Dubai International Financial Centre (DIFC) focusing on strengthening commercial ties with Africa, what sector-wide opportunities do you foresee for enhancing trade financing and economic collaboration in the region?

While a significant amount of Foreign Direct Investment is flowing through Mauritius, we have also seen African entrepreneurs and funds exploring Dubai as a platform for cross-jurisdictional investment and portfolio financing. There is also a growing interest for projects linked to green energy or cleaner energy source. Dubai is also home to some of the key traders for facilitating movement of commodities across the world, while Africa is the warehouse of the major soft and hard commodities. In this equation, having a stable and internationally reputable IFC like Mauritius provides the necessary framework for trade facilitation and financing. Mauritian IFC has been active in welcoming the procurement arms of various African and International corporates. The tie up with MIFC and DIFC, provides a unique opportunity for value addition for the players within the two ecosystems.

Looking at the broader picture, what do you believe are the key factors or advantages that make Mauritius’s financial sector an attractive destination for business and investment, especially for the MENA region’s business-oriented audience?

The Mauritius IFC offers a comprehensive range of services, catering to both banking and offshore management company needs. High-net-worth individuals and businessmen are looking for tailored and sophisticated services through Special Purpose Vehicles for asset protection, wealth preservation, enhanced returns, and well-structured succession planning. Mauritius, providing both fiscal and non-fiscal benefits, imposes no withholding tax on distributions to shareholders/investors and has no capital gains tax. The Mauritius IFC is also regarded as a low-cost jurisdiction with highly skilled and qualified pool of talents.

In addition to being part of regional bodies like COMESA, SADC, and MIGA, Mauritius excels in political stability, offers a business-friendly climate, and operates within a favorable time zone. Supported by a well-developed infrastructure validated by international entities, including banks, law firms, audit firms, and listed companies, Mauritius serves as an ideal nexus for facilitating business engagements between Africa and Asia. The island strategically connects the MENA region with key global markets, particularly Asia, utilizing its robust network of Double Taxation Avoidance Agreements and Investment Promotion and Protection Agreements.