Banking plays an essential role in facilitating business, trade and finance. At AfrAsia, what has been the impact of CECPA? What strategic advantages do you derive from Mauritius' position as a gateway between India and Africa to attract and retain customers from these regions?

The CECPA has three main components namely trade in goods, trade in services and the economic cooperation chapter. On a stand alone basis, Mauritius being a net exporter from India, this has been beneficial from the elimination of the duties.

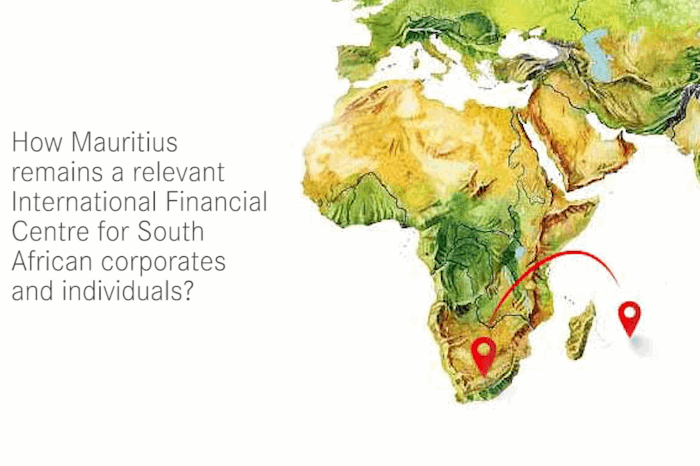

The CECPA provides market access for around 600 products at preferential rates to a global economic powerhouse with enormous economic potential. With CECPA offering flexible rules of origin for a number of products. This is an important provision, as it allows use of non-originating materials to a certain percentage of the export price and product specific rules, which allow up to 35% value addition. This provision is particularly relevant in the context of the value chain, as it intends to take advantage of the vast African market. Mauritius is set to benefit from its strategic location and economic ties between Africa and India.

Moreover, being a member of the AfCFTA, the strategic advantage of Mauritius is further magnified in this triangular relationship. In order to achieve the goals under the AfcFTA, there are three ingredients crucial to its success, namely, funding, technology transfers and capacity building. From an economic corporation chapter under CECPA, Mauritius, can attract Indian investors to set up in Mauritius as a gateway for investment and transfer of capacity to Africa. Mauritius may be small in size but can have wide reaching influence on the African continent. The main factors to drive this commercial relation are the sophisticated level of professional skills, the rule of law, an established democracy, a bilingual workforce, the absence of exchange controls, as well as the fact that there is no capital gains tax or inheritance tax, further contribute to positioning Mauritius as the gateway between India and Africa.

How exactly does your bank facilitate trade and investment between India, Mauritius and Africa, and what specific financial products and services does it offer to support cross-border transactions in this triangular relationship?

The bank has aligned itself with the ambition nurtured by Mauritius to act as a competitive gateway for channelling trade and investment flows into Africa. The contribution of AfrAsia in this process is to leverage on its established banking network reach between Africa and Asian banking counterparts to facilitate trade and investment. This allows the bank to connect with best financial institution in both continents for trade facilitation and also in debt fund raise.

We service the clients throughout the spectrum of their corporate banking needs, including corporate balance sheet lending, trade finance solutions, acquisition finance, project finance, foreign exchange, hedging, cash management solutions, as well as any other transactional banking needs. From a transactional banking perspective, we also service corporates and investment funds carrying out business in Asia whilst capitalizing on the Mauritius International Financial Centre.

In addition to a dedicated team to assist the clients day-to-day transactional requirements, FX solutions and in their debt funding, we have a coverage team capturing the said markets with regular ground presence.

What sectors have seen the most significant collaboration facilitated by your bank between Mauritius, India and Africa, and how do you identify, or even target, key economic sectors to promote stronger trilateral ties?

From a financial partner perspective, we observe that over the years, India-Africa trade has undergone significant shifts, driven by overarching trade goals and changing dynamics. The African Continental Free Trade Area (AfCFTA) has expanded the horizons for India – Africa trade.

India and Africa have prioritized key sectors to boost bilateral trade and address common challenges. In the food and agriculture sector, both regions focus on food security, promoting agricultural technology and trade. Energy security is achieved through collaborations in the oil and gas sector, with Indian investments in African oil fields. Mining and minerals attract Indian investments, creating value in Africa. Manufacturing in Africa for exports is encouraged to boost job creation and economic diversification. The pharmaceutical industry sees collaboration in affordable generic medicines and healthcare infrastructure. Electrical machinery and equipment offer technology transfer and capacity building. The automobile and transportation industry benefits from Indian manufacturers setting up assembly plants in Africa. Sustainability and green energy solutions align with environmental goals, fostering renewable energy adoption and clean-tech advancements.

The strategy of the bank is to accompany its client in their African growth journey and to unlock potential. In this process, we note that African corporates have set up their financing and procurement house in Mauritius for both sourcing of key inputs and debt raising. In the collaborative process, we have facilitates innovative, flexible and attractive structure to finance clients` working capital and trade finance and longer term funding requirements across sectors namely in strategic commodities, metals, pharmaceuticals along with providing assistance to PE Funds. This is in addition to to assist the clients day-to-day transactional requirements.

The bank is aligned to accompany its existing and potential clients in their value creation journey and remained committed to support their financial requirements in that process by being sector agnostic.

To date, what are AfrAsia's strategic priorities and future plans to strengthen its role in the India-Mauritius-Africa triangular relationship, and how does the bank plan to take advantage of emerging opportunities in the African market as it continues to grow?

AfrAsia Bank has aligned itself with the ambition nurtured by Mauritius to act as a competitive gateway for channeling trade and investment flows between the Asia-Africa corridor as well as serving financial needs across the value chain to both individual and institutional investors.

The Bank focusses on accompanying its clients in their existing business ventures and their expansion in Africa. The Bank is positioned from a transactional, global markets and corporate funding perspectives to fulfil the financial requirements of its customers.

We have developed strong ties with key stakeholders in both Africa and India ranging from institutional clients, Private Equity funds, DFIs and conglomerates which enables us to facilitate both trade and capital flows between the two continents. Our asset exposures cross multiple African countries as well as multiple countries in Asia including India.

With Mauritius being a member of AfCFTA and CECPA, there is more opportunity that can be tapped. In order for the Mauritian IFC to remain more meaningful in this journey of valuation creation between India and Africa, there is need for more sophistication of the financial players to be able to support in the most innovative and disruptive way. We are exploring ways to increase our business knowledge in certain sectors, which have deep investments between Africa and Asia, commodity financing across the chain being a good example.

The Bank leverages on its Financial Institutions relationships across Africa to extend its market reach and facilitate trade flows for its clients. The strategy calls for a proactive approach to extend the network reach for ensuring our clients to tap untapped markets with a first mover advantage along with their financial partners.

Get in touch:

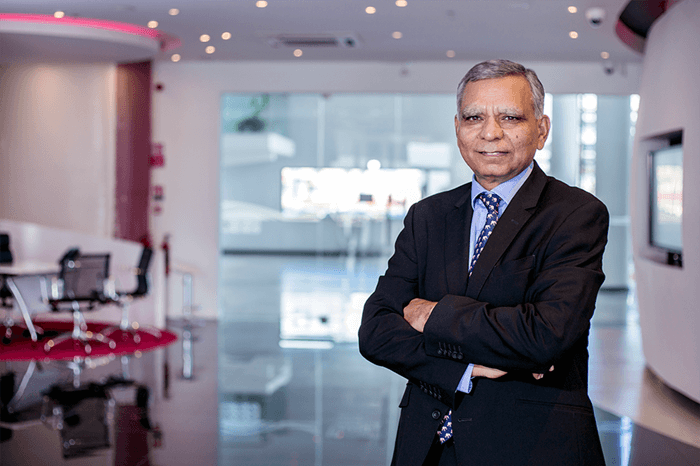

Navin Ramdoyal - Head of International Corporates (Africa)

Email: Navin.Ramdoyal@afrasiabank.com

Tel: (+230) 403 6968