At the height of the crisis last year, the price of the oil barrel turned negative. However, it hovers today above 60 dollars. Is this a show of confidence in a faster economic recovery?

There are a number of prices associated with the oil market. Namely that of Dubai, Oman or even China (listed in Yuan). But the two main references are the American WTI and European Brent; two references which usually have similar evolutions. However, there was indeed a short period of time during which the WTI price was distanced by the Brent and was trading in negative territory, whilst the Brent stayed near USD 20. U.S. oil price was technically negative but only for the May delivery. Then, prices gradually resumed an upward trend as economies reopened and strict lockdowns slowly lifted.

Oil continues to be a leading global economic growth indicator due to its role as primary energy source. However, it is also important to understand its market’s unique supply and demand characteristics. Today, the price of oil is artificially high because of the consensus between the OPEC and a few other producing countries (OPEC+) to limit oil production. On the one hand, economic recovery, namely in the USA and in China, will be strong, as reflected by the OECD's upward revisions of the global growth rate to 5.6%. A forecast which means that we should return to pre-COVID levels of global wealth as early as during this year's second quarter. On the other hand, this growth acceleration will drive OPEC countries to relax production quotas. In fact, world oil production has been lower than consumption during the last 3 quarters but is expected to return to positive territory during 2021 Q3. So yes, the price of oil reflects the optimistic view on global growth, but production quotas have also had an impact on this market, stabilising prices before they probably rise again once air transport really takes off. Indeed, the aviation industry alone accounts for 8% of final oil consumption. However, a return to normal in this sector is not expected before at least 2024.

Has the global vaccination campaign helped boost oil prices?

Definitely, and in fact, this was made clear last week when, in one day, oil dropped by 7% due to reinstated lockdown measures and the slow vaccination campaign in Europe. A new wave of Covid-19 infections across Europe caused new lockdowns and dimmed the expectation of imminent fuel demand recovery. Moreover, vaccination programmes were hampered by distribution problems and concerns about possible side-effects. Great Britain even announced that, next month, it would have to slow down the deployment of its COVID-19 vaccines due to delays in supply. However, we probably will not see a return to pre-pandemic levels of oil consumption until 2023. Incidentally, oil consumption only fell by an average of 10% in 2020.

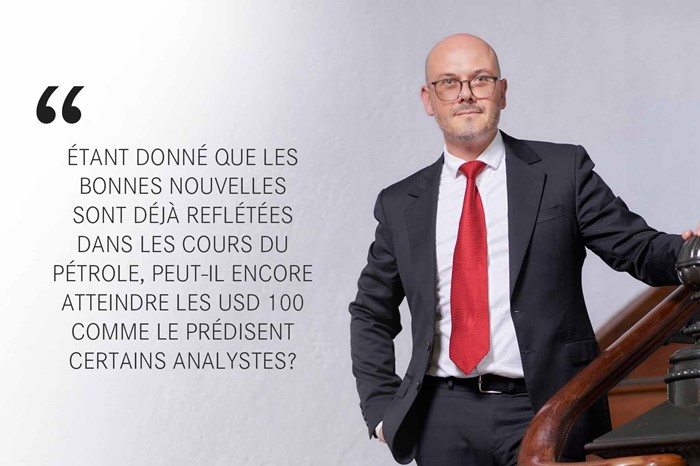

How will oil prices, namely that of the Brent, evolve during coming months?

Even though some analysts expect oil to hit USD 100, it seems that most of the good news associated with growth, the reopening of economies, etc. are already factored in in current prices. And since, at USD 60, shale oil becomes profitable, there should be an increase in the American supply as well as OPEC+ member countries' productions as they gradually return to their pre-crisis production levels. The cartel is still underproducing by approximately 8 million barrels per day, for an average consumption in 2021 expected to rise to 97 million barrels per day, i.e. an average increase of 5 million barrels per day. Supply imbalance thus persists. OPEC+ members are convening on 1 April to determine new production quotas for the month of May.

Long-term measures have also been implemented by governments to support the use of alternative sources of energy. Total oil company's managing director announced that, 10 years from now, a cut in favour of renewables will result in oil and gas accounting for only 40% of the Group's energy mix, instead of the current 60%. A transition and new make-up of the energy mix that will likely put even more pressure on oil prices.

It goes without saying that higher oil prices will have an impact on our oil bill in the coming months. How will that affect our balance of payments?

The trade balance should worsen as oil prices rise since this will increase import costs, whilst exports have, as at January 2021, declined by 22%. For the month of January 2021 alone, this could mean a USD 206 million deficit. Mauritius faces the double penalty of a devalued rupee, and the unlikelihood of it strengthening as long as borders are not reopened to renew forex momentum. Oil accounted for 20% of total imports in 2021, putting a strain on the trade balance that can only be offset by a positive capital and financial balance, i.e. more foreign investments in Mauritius rather than the other way round. It is thus imperative that Mauritius increase its appeal in order to attract foreign capital, but the current yield curve is not going to help and neither will the blacklist.