“This is the greatest economic opportunity we’ve ever had’,’ said John Kerry, the US Presidential Special Envoy for Climate, during the opening session of the IEA-COP26 Net Zero Summit last March. “We are looking at the biggest job market ever known. Every task we have – building out the grid, solar power, wind power, building out hydrogen batteries, switching to electric vehicles – will all create jobs.”

Since the 2015 Paris Agreement, countries around the globe have been analysing their energy strategies and had set themselves targets to increase the share of renewable energy generation and reduce carbon emissions. Some countries have made significant progress while others are acting at a slower pace but are progressing nevertheless.

When we speak of renewable energy and reducing carbon emissions, we immediately think of solar panels, wind farms and electric vehicles (EVs) – it’s this very line of thought that has driven AfrAsia Bank to craft a Green Car Loan for its clients. Whilst there is an undeniable opportunity for growth in these sectors, what is actually the common denominator to benefit from such a growth? It boils down to one word – BATTERY!

Increasing energy needs v/s a sustainable future

Increasing innovation and demand for reduced emissions has put the energy transition at the forefront. However, the question remains as to how can we meet the ever-growing future energy needs while ensuring a sustainable future? As per the International Energy Agency (IEA), ramping up batteries and storage by 50 times over the next 2 decades will help us achieve the afore-mentioned.

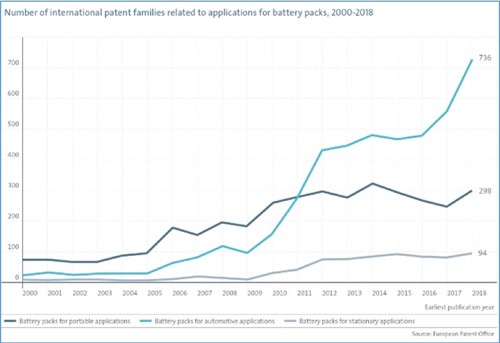

From the IEA Report entitled ‘Innovation in Batteries and Electricity 704 Storage’, more patents are being filed in battery technologies than ever before. From 2005 to 2018, there has been an average annual growth of 14% globally in patenting activity for batteries and other electricity storage technologies – this is four times faster than the average growth rate across all technology fields.

Battery innovation is playing a key role in the transition to clean energy and as was mentioned earlier, the findings of this report also point to a much larger driver in recent years: clean energy technologies, and in particular, electric mobility. From 2000 to 2018, 65% of all battery pack applications related to the automotive segment; that is, applications regarding electric vehicles (EVs).

Electrification is the new norm

The momentum towards the electrification of passenger vehicles is the current big theme in the automotive industry and it seems to be unstoppable. Original Equipment Manufacturers (OEMs) are racing to match up with Tesla’s competitive advantage in the field whilst striving to ensure compliance with all regulatory pressures. The need to conform to all CO2 targets has significantly heightened and this means that electrification has shifted from being an option to being more of a necessity.

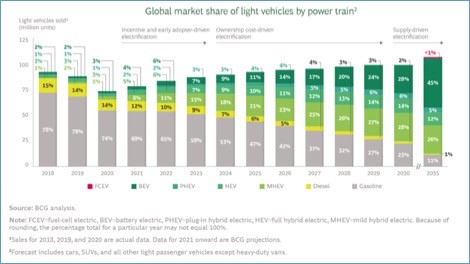

As such, key automotive players have set public targets for electric-vehicle adoption. For example, Jaguar has pledged to become an all-luxury electric brand by 2025 whilst Ford and Mazda’s entire passenger vehicle lineup will run solely on electric batteries by 2030. Volkswagen and Volvo have undertaken the commitment to stop internal combustion engine (ICE) production by 2030 whilst BMW has announced that half of its passenger vehicles will be electrified by the same year. By 2035, the majority of GM vehicles sold will be electric-powered.

According to the Boston Consulting Group’s (BCG) analysis, the global market share of EVs would be 88% by 2035.

The Global Market Share for Batteries

Now that all these facts have come to light, it is obvious that this booming electrification trend will bring about a surge in demand for one essential technology: battery packs.

According to Research and Markets’ Global Battery Market Report 2020-2027, the USD 120.4 billion estimation of the global market for batteries in 2020 is likely to reach a revised size of USD 279.7 Billion by 2027; this means that this market will grow at a Compound Annual Growth Rate (CAGR) of 12.8% from 2020 to 2027.

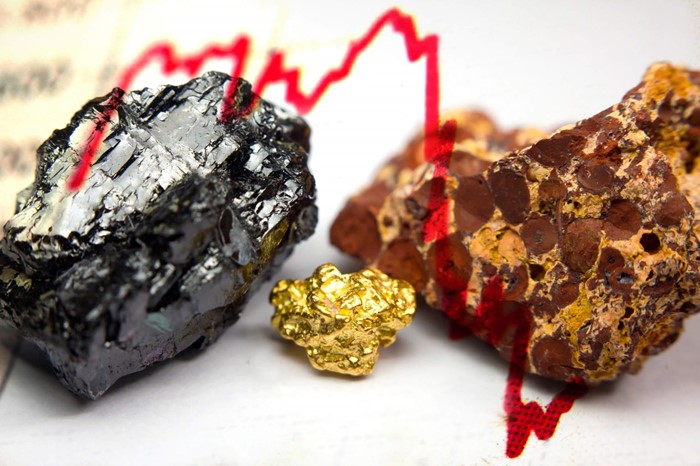

Will electrification catalyse the demand for Nickel?

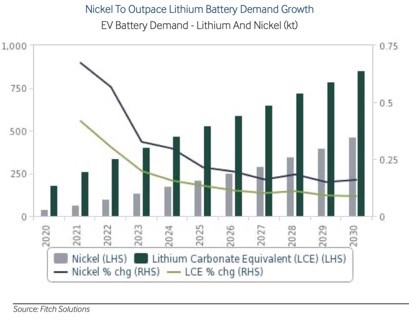

The EV battery revolution is likely to have a sizeable impact on the demand for key battery materials such as nickel, as well as copper and aluminum. Nickel represents a key component within metal hydride and lithium-ion battery chemistries, typically used in industrial sectors. According to the European Commission’s Joint Research Centre’s 2021 report entitled ‘Study on future demand and supply security of nickel for electric vehicle batteries’, automotive electrification is expected to represent the single-largest growth sector for nickel demand over the next twenty years. Fitch Solutions expects nickel demand for EV battery manufacturing to experience an annual average growth rate of 29.2% over 2021-2030—outpacing demand for both lithium and cobalt.

A Promising Future for Copper

EVs have more copper electrical cabling than a normal car and the battery itself has lots of copper in it. An EV can have as much as 100kg of copper compared to 20kg for a standard gasoline or diesel car. In addition, increasing amounts of copper are needed to rollout the necessary electrical infrastructure: charging stations, grid builds out or cabling around new power generation. According to Goldman, as the transition to green energy accelerates and the supply of the metal tightens, copper prices are expected to rise significantly. Last Friday - 7 May 2021 - copper futures rose to an all-time high of USD 10,440 a ton in London, continuing its sizzling rally that has seen its price more than double within a year. The previous record was set as far back in 2011 in the commodities super cycle driven by China’s rise to economic heavyweight status. Citi is also firmly in the bull camp stating: "We highlight that the 'super' part of the supercycle is now with the market facing the largest supply deficit since 2003-2004”. This time, investors worldwide are piling into copper due to its vital role in the world’s shift to green energy.

Aluminium is the new favourite for boosting EVs performance

Today, electrification is swinging the pendulum in favour of Aluminium from its previously preferred cheaper contender, steel. Significantly lighter than steel – about 1/3 per cubic foot – Aluminium lightweights an electric vehicle and boosts its overall performance by improving the distance covered per fully-charged battery. Secondly, Aluminium is gaining momentum due to its enhanced security aspect; crash tests have proven that it protects the passengers and the car’s structure better when accidented. All these factors are boosting the demand for Aluminium on the global automotive market and we can predict that the coming years will witness a boom in the market price of Aluminium as it will be a highly-traded commodity on financial markets.

Do you want to invest in the next big opportunity?

The electrification of the global automotive market has made significant progress over the past decade and the pandemic has surely fueled the desire for a green economic recovery. Given their key contribution in this electrification chain, Nickel, Copper and Aluminium are valuable pillars that will drive the shaping up of a sustainable automotive industry.

If we combine the booming demand for these valuables over the past 5 years and the commitments undertaken by automakers worldwide to electrify their production, it looks like we have an investment opportunity on the horizon, ceteris paribus.

If you are looking for your next investment opportunity and this article has piqued your interest in Nickel, Copper and Aluminium, get in touch with our Structuring Team and we can discuss about how best to tailor our structured products to your risk appetite and financial aspirations.

Ashvind Boobun

Chief Analyst – Structuring

E: Ashvind.Boobun@afrasiabank.com

T: (+230) 5253 4898

Khirita Ajoodha

Analyst - Structuring

E: Khirita.Ajoodha@afrasiabank.com

T: (+230) 5254 3508

Raveen Ramlakan

Head of Structuring

E: Raveen.Ramlakan@afrasiabank.com

T: (+27) 11 268 5780