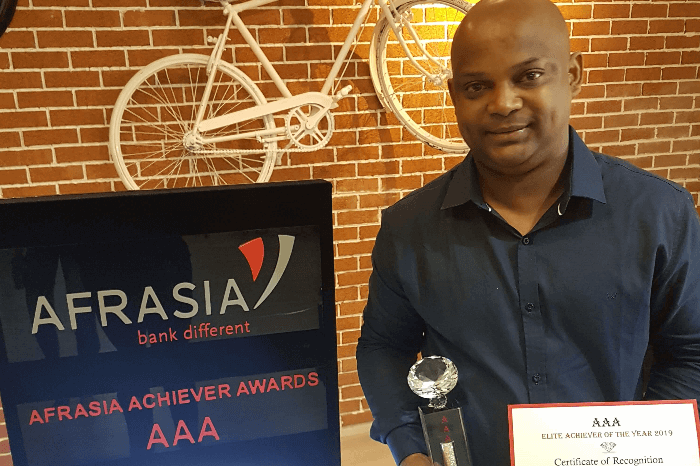

Investor’s Mag talks to Sanjiv Bhasin, CEO of AfrAsia Bank Mauritius. He talks about the economic progress of Mauritius and the contribution of the banking sector to help Mauritius becomes a global player. He also reveals AfrAsia’s strategies to penetrate the African market and how his bank is helping to build an identity for the local tourism and financial sectors.

What is your overview of the economic progress and health of the Mauritian economy?

If you look around and pick up an economy which is consistently successful, the country which stands out is Mauritius. It has been able to succeed in terms of creation of wealth or in terms of GDP, and has also been well integrated socially and has uplifted the standard of living of all people. It gets a tick mark from all kind of evaluation. It has been one of the better, if not the best performing economies globally. Yes, you have to admit that it is small, there’s no doubt about it. But even if you benchmark it against small economies, its track record or performance is enviable. All in all, full marks for this economy, it has been an outstanding performer.

What is the contribution of the banking sector to the economic development of Mauritius?

You have to accept a point of view, that a successful or stable and strong banking industry is necessary for a robust economic environment and growth. If you agree that the Mauritian economy has been a grand success for a while, you will then have to admit that it has a very sound and stable banking industry. The contribution of the banking industry and its growth in the financial services sector has been phenomenal. This has added value to the whole economic horizon. The contributions of the local banking sector go beyond the borders of the island. They have also spilled into the African continent, in Asia and Europe as well. This industry has been the backbone of economic success for Mauritius. Today, it is contributing towards Mauritius being one of the better regarded offshore banking jurisdictions and is giving the country the required propulsion towards being a global player.

Can Mauritius truly establish itself as a global trade hub in the coming decade?

In the future, yes. In the current environment, you will have to admit that in the financial services space, Mauritius occupies a very strategic position on the global platform. It is a gateway for capital into Asia and Africa; both have been the recipient of large volumes of capital from Mauritius. Look at the trade agreements that Mauritius has with Africa, and parts of Asia, the Double Taxation Agreements,

and the Investment Protection Agreements. Efforts were made to ensure that this country becomes a financial hub towards the growth

of countries in Asia and Africa. It has the talent and the regulations. It has regulators who are modern and are facilitating and protecting the jurisdiction against adverse practices or policies which can damage the reputation of the country. There is no doubt that the international financial centre is excelling and will continue to excel. Now, coming to the trade hub, it is an opportunity to be further developed. It requires sea and air connectivity. It also needs to have a very large scale infrastructure and labour to make it a manufacturing and transshipment hub. The signs of that happening in the near future are obvious. With the level of investment happening in the country, from the creation of smart cities, to the modernisation and expansion of the and the airport, there has been a vast improvement in connectivity in travel from and through the country. All signs are pointing in the direction that it will become an effective trade hub for Africa and Asia. We can see that trend taking shape at the moment.

What is AfrAsia’s strategy regarding the African continent?

What AfrAsia has done is to read the future trends of capital flows. The capital coming to Africa is mainly from Europe, Asia, and the US. We have created a niche for ourselves where we try to understand what the institutional investor is seeking, and the kind of products and

services they want. We are trying to improve continuously to handle this activity best. The customer service, the customer experience,

and the enabling technology have to be upgraded constantly. It is a never-ending marathon. You have to keep improving. You cannot reach a particular pinnacle and stay there, and say “I’m the best now!”. I will never be the best. I can only remain one of the best, provided I am willing to keep changing and keep running. One thing we are trying to build in our DNA is to improve ourselves constantly. So, I have to keep changing my people, their attitude, their thinking, and also keep modernizing our platform to best service the customers. That is

why I say ‘a never-ending marathon’. Yes, sometimes you could walk, and sometimes you can look back. But the day you stop progressing and moving ahead, you will be history. You cannot stay still; you have to be able to run, walk, and sometimes look back and run.

Many observers say that sustainability is the next step in banks’ evolution. What do you think AfrAsia Bank’s key contributions have been in this field?

Fundamentally, it is well accepted that you have to make sure that you leave the current environment in a far superior shape than the way you have inherited it. You have to make sure that the future generation has the benefit of an improved environment. If you want to preserve and enhance the environment, you have to change how you conduct yourself. You have to adopt practices that protect the environment. What have we done? We have tried to imbibe simple philosophies and policies that are easier to introduce immediately.

Then, we have taken a bold step forward to organise the AfrAsia Bank Sustainability Summit, engineered to facilitate the understanding of

Banking Space sustainability, what it all means, and how it can be converted into adopted policies and processes in the social and corporate framework. We also bring together practitioners of sustainability so that they can share their experiences as to how they led

the change to imbibe and introduce sustainable philosophies. We now also have technologies that are environmentally friendly, for example, solar energy. How can you adapt that? How can you access that? How to finance that? That is what we are trying to do – so that we bring in the forefront the need to change and make it easily adaptable within the existing environment.

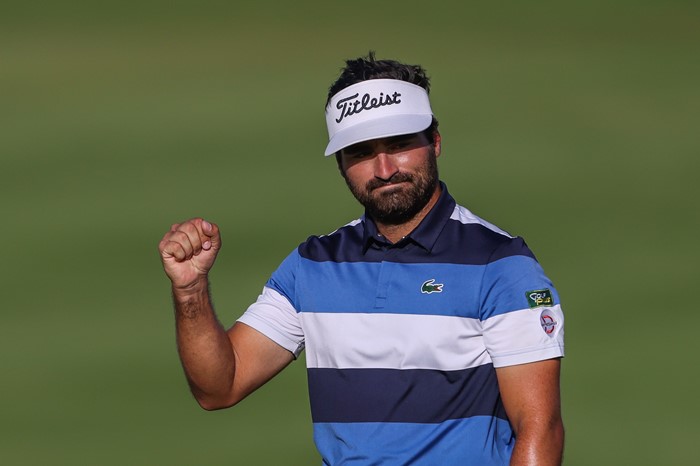

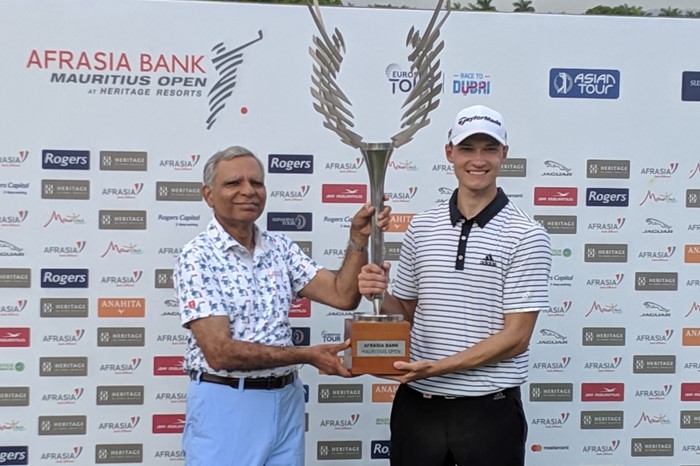

Mauritius will be hosting the AfrAsia Bank Mauritius Open for the fifth consecutive year in 2 weeks. What has been the economic impact of this tournament for Mauritius?

Mauritius is a great tourist destination, and it has one of the best golf courses around the globe and is one of the prettiest places to visit in terms of sun, sand, sea, and the climate. This AfrAsia Open primary objective is to position Mauritius on the global platform as the most preferred tourist destination. When positioned in that perspective, we can also highlight the fact that it is a great golfing destination

with many championship courses. This tournament brings together the perfect private and public partnership; that is, we have the Government and the private sector coming together to position Mauritius as the most favourable destination for tourism and golfing. Along with golf, we are also positioning it as a sporting destination, so it helps to create an identity for the tourism industry. Once done, the

benefits automatically flow. Since the island already has a very robust financial centre and is established as an offshore commercial centre, it becomes the place to visit, to relocate, to transfer and manage your wealth, and conduct your business. We are very privileged to position the island so that the economic benefits from this activity percolates to all segments of the economy and society.