In an ever-changing world, where sustainability has moved from the sideline to the forefront, investing is no longer about making a profit only. Increasingly, people want their investments to leave a positive imprint on the world – a belief that has fuelled the popularity of ESG Principles. What are those principles and how does it help to build a sustainable financial future?

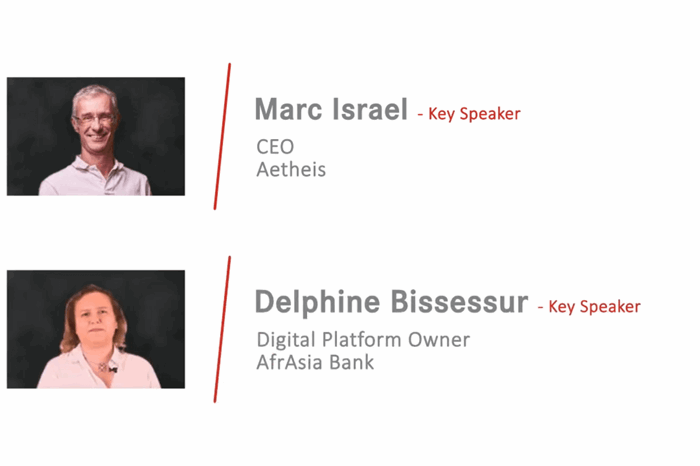

During a webinar under the “20 Min with AfrAsia” banner, Edouard Chevalier – Project Manager at Agence Française de Développement, Nicole Martens – Head Africa and Middle East at Principles for Responsible Investment (PRI) and Luvna Arnassalon-Seerungen – Head of Corporate Sustainability and CSR at AfrAsia Bank elaborated on the subject matter.

What are ESG principles?

An abbreviation for ‘Environmental, Social and Governance’ and a widely-used term to refer to sustainability in the banking arena, ESG principles are the three parameters in measuring the sustainable and ethical impacts of investments on society. At the core, ESG sets a guiding framework for responsible investment and today, ESG is increasingly being used as a baseline for measuring the success of companies.

Responsible investment as a fulcrum for a more responsible and sustainable world

ESG allows investors to effectively assess an organisation’s resilience, adaptability, long-term sustainability and capacity for growth in a holistic manner. As rightly pointed out by Nicole Martens, there are indeed challenges in embedding ESG into all aspects of the business: “Undeniably, you will have numerous challenges such as getting the internal buy-in and revisiting existing structures. That said, the biggest challenge remains to get started, but PRI has made available principles-based handbooks that act as guides to kick-start your journey. And trust me, once you get the balls rolling, it becomes easier to advance on the sustainability and responsible investment journey.”

SDGs: A lens through which ESG principles can be applied for a sustainable World

Investing in sustainable alternatives is generating a lot of buzz around the world at present; this is seen as a way to generate both financial return and impact. Incorporating ESG factors into one’s investment approach and active ownership decisions has shown to have significant financial materiality. But how exactly can we do that? The solution is right in front of our eyes: by using the frameworks provided by the SDGs as a guidance.

A blueprint to shaping a more sustainable world, the 17 SDGs address global challenges that we are presently facing. Therefore, aligning same to one’s operations de facto entails the creation of a Shared Value Business Model, underlining the incorporation of ESG principles in the day-to-day management of the business.

That said, today, a lot of Shared Value Business Models are mostly coming from Small and Medium Enterprises (SMEs). These models embed SDGs at their core, which might not always be the case with large corporations. Yet, in many cases, the main hinderance is that smaller businesses might not yet be bankable, or the deal size might be too small to be viable for larger investors. In such cases, funds that specialise in support of SMEs are very attractive as they present an opportunity to invest in SMEs, but at scale.

Evolution of ESG in Mauritius

The evolution of ESG in Mauritius is anchored on its adaptation to some growing concerns. According to Luvna Arnassalon-Seerungen, the World of Business ‘as usual’ will have to advance towards what we now call ‘Business Unusual’. Luvna highlights: “The world is changing and international sustainability challenges, such as COVID-19, rising sea level and regulatory pressures, are introducing new risk factors for investors that might well be unprecedented in nature.”

As companies are facing a global complexity of adaptation and mitigation, investors may want to re-evaluate traditional investment approaches. These investors may seek to direct their capital towards companies that provide solutions to environmental or social challenges and monitor the extent to which their investments are generating positive social or environmental impacts alongside their financial returns.

Additionally, through better data from companies complemented by more in-depth ESG research and analytics capabilities, we are witnessing more systematic, quantitative, objective and financially-relevant approaches to ESG key issues. If the macroeconomic factors around ESG are not well thought and the policies and regulations around this subject are not defined, the evolution of ESG principles and practices will remain at the micro perspectives. Without this framework, the key question we should be asking ourselves is: How do we advance to the next level?

Banks: Financial levers in transitioning to a more sustainable world

Financial institutions have a key role to play in transitioning towards a low-carbon economy. We want to reduce our direct and indirect impact and also give our customers an opportunity to contribute to climate solutions.

Acting as platform to facilitate the transition to a more sustainable world, the Agence Française de Développement, is a development bank working towards the promotion and implementation of green projects worldwide. Edouard Chevalier comments on the role of AFD as a catalyst in breeding a global sustainable investment culture: “AFD is an entity that provides financial support to global entities embarking or advancing on their sustainability journeys. Through mainly loans, and secondarily, grants and technical assistance, the AFD aims to encourage more sustainable projects. By drawing up a sustainable development analysis of each project that we are likely to fund, we have a clear picture of the extent of the positive outcome on climate change resilience, transition to a low carbon economy and biodiversity conservation, amongst other criteria. And, I am happy that AfrAsia Bank can in turn make a positive change locally and regionally now that it is embarked on the SUNREF programme and has availed of Rs 470m line of credit from AFD.”

AfrAsia Bank embarked on the SUNREF programme: Read More here