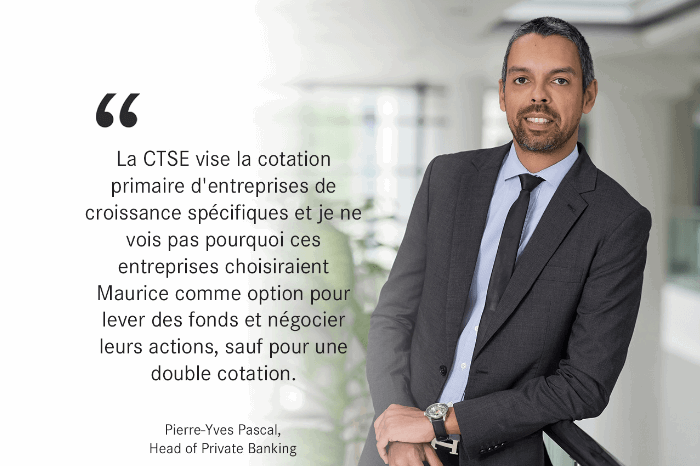

What is your appraisal of AfrAsia latest financial statements?

Our performance for the first half 2018/19 is encouraging and demonstrates good growth. This result is a combination of increase in operating income, improved earnings from all business verticals as well as the recoveries of non-performing assets. A deposit growth of 5,9% in the last 6 months (Jul-Dec 2018) from existing and new customers gives us the confidence that our trajectory is providing the comfort to our customer base. This makes the ABL team very motivated and passionate to continue the journey. The credit and liquidity environment will create headwinds in the next 6 months and the ABL team is prepared to seek specific & select growth opportunities to ensure we remain on this growth momentum.

How do you explain the momentum the bank has renewed with?

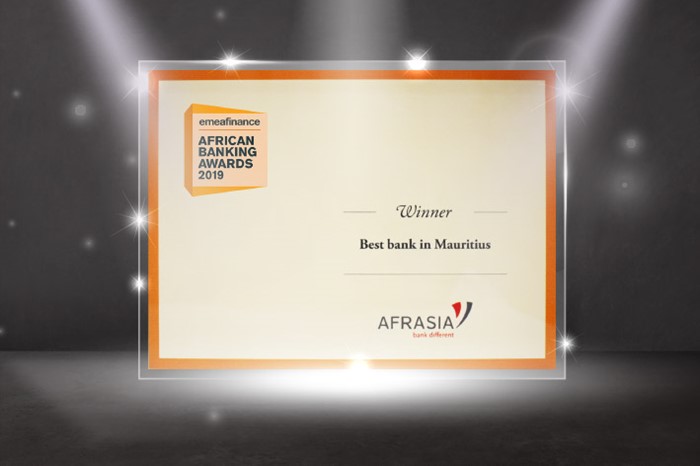

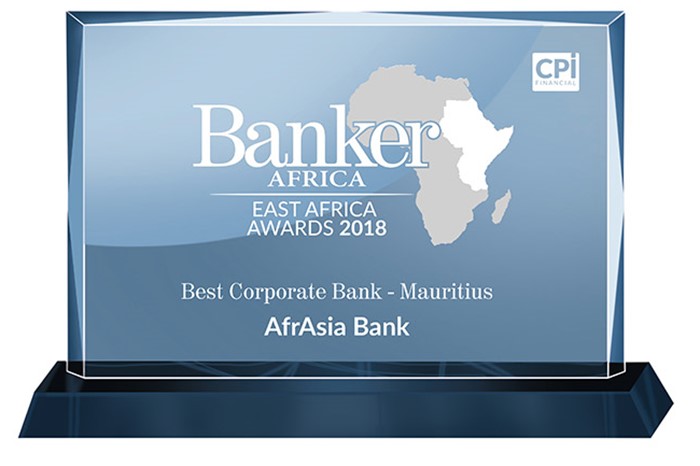

A short answer is we stayed true to our ‘bank different’ philosophy. In 2018, we continued to further transform the customer journey by putting greater emphasis on delivering superior experience to our customers, employees and all stakeholders. The positive impact is reflected in our performance and in the power of our brand. We are proud that AfrAsia Bank was recognised as the Best Bank in Mauritius at the 11th edition of the EMEA Finance’s African Banking Awards in December 2018. A superior customer experience is key to our ongoing success and this achievement enables us to approach 2019 and beyond with confidence. We are constantly attempting to get better at understanding this dynamic environment while we continue to invest in technology to create a more differentiated banking experience and to elevate our customer service. The team is conscious also that the voice of employees remains in the forefront.

Can we expect new interest for the African continent for your activities as a result of this?

For us the hinterland is Africa. All macro trends suggest that the continent will receive new investments in the future and also register increasing trade flows. All African economies will show upraising signs of growth. If we take a look at some of the countries in Africa, their GDP growth rates have already risen. Tanzania, Kenya, Uganda, Ethopia and Rwanda are all growing in the range of 5 to 9 percent. A recent interview given by the World’s Bank chief economist for Africa also says that the growth in the region is projected to increase from 2.7% in 2018 to 3.3% in 2019. Mauritius is well positioned to be the center which can receive capital from the West or the East, from Africa or Asia, and thereafter channel these funds into investments wherever is needed. That is a role Mauritius can potentially play, given its position and effective jurisdiction in that regard. This will enable us to increase our business. The challenge, as in any business, is to be able to manage the risks. Today, a major part of the business is driven by Clients based in, trading with and/ or investing in Africa.

What are your expectations with regards to the performance of the local economy in 2019? Where do you see growth coming from?

The economic growth of Mauritius has been excellent right since independence and this track record and the overall intent to progress to a level of High Income nation appears eminently possible. The question: How have I reached this conclusion?

Let us start with the visual display on the island where you see modern infrastructure to remove all bottlenecks. You see office, commercial and residential construction/redevelopment. You see new hotel properties and renovation of existing ones. All this suggest preparedness for growth in business and possibly attracting new businesses. We can expect more markets opening for tourism. The film industry selecting Mauritius for content development is on the rise. Funds management can be an arm of the financial services industry which can grow. As said before, Africa will attract more investment and this jurisdiction is likely to remain the preferred place from where it shall be managed. I can go on but all I wish to state there is clear visibility towards meaningful growth. We will witness continued development and a rising GDP. This island has all that is needed to demonstrate future sustainable growth trends.

Coming to the global picture, with Brexit becoming definite, how prepared do you feel Mauritius is to fully manage its dependency on the UK as one of its main export and tourism markets?

Whilst Brexit is looking likely to happen, when it will happen and under what conditions still needs to be determined and agreed by the UK Govt and the EU. I believe Brexit could actually open new opportunities for Mauritius as a trading partner. Moreover, home to the City of London, the world’s leading financial centre, the UK is well-positioned to become Africa’s future investment partner of choice. Initiatives announced in support of this include:

- CDC, the UK’s Development Finance Institution, will significantly increase its investment into Africa – aiming to invest up to £3.5 billion in businesses on the continent over four years. This will support hundreds of thousands of jobs, build stability and trigger growth in some of the poorest and most fragile countries.

- A new investment of up to £300 million of UK aid invested through the Private Infrastructure Development Group (PIDG) will build essential infrastructure such as power, roads and water, that will lay the foundations for new trading and business opportunities across Africa in places businesses previously would not have been able to operate.

Mauritius is likely to benefit if it can find ways to position itself as the springboard for investment in the Continent.

Is the mutation of the financial services sector in Mauritius cause for concern according to you, when it comes to conserving our fiscal advantage and remaining compliant to international norms?

The Mauritius financial services sector is currently undergoing a major reform with the view to retain its investment appeal through fiscal advantages that will continue to attract global investors, while ensuring compliance with international norms and standards in a post-BEPS world. The measures announced in Budget 2018-2019 and the recent release of the Blueprint go in the right direction of maintaining an appropriate balance between these two often competing objectives. In this context, the challenges are great – but so are the opportunities. Mauritius has ambitious plans to position itself as a specialist regional IFC, drawing on its long-established links and expertise in Africa and India. The success of these plans depends largely on a competitive fiscal regime that meets international norms and standards in line with EU and OECD requirements. The recent steps taken by Mauritius in this direction represent a positive development for its financial services sector rather than a cause for concern.