Since its inception, AfrAsia has been embarking on an audacious strategy in order to tap into the growing trade, investment and capital flows between Africa and Asia, says its Senior Executive – Head Corporate & Personal Banking, Africa.

1. AfrAsia has recently been awarded ‘Best Corporate Bank’ by Banker Africa. How do you define this success?

This award is a testimony to our unremitting efforts in delivering a superior service to the one core element that drives the bank - our customers. AfrAsia’s success is defined by the extent to which our existing clients continue to bank with us and our ability to attract new customers by providing a truly differentiated banking experience. That experience is one that is truly client centric: engaging with them with an ‘entrepreneurial’ mindset to understand their needs, objectives and aspirations.

This ultimately shows that the AfrAsia brand continues to deliver and attract valued customers in both domestic and international markets. We remain committed to offering a more distinctive value proposition, creating more synergies across our core business lines, by drawing on our expertise, strong relationships and customer-centric approach. This award, that we’ve bagged for the second consecutive year, confirms our successful business model as we continue to be the chosen business partner for growth.

2. What are the trends you are seeing in Mauritius and the region in the corporate lending space?

In Mauritius, we see refined investment taking place in infrastructure and property particularly the Smart City initiatives driven by both the government and private sector. The Smart Cities being developed across the island is aimed at boosting development and investments in the country, consolidating hence the Mauritian International Business and Financial Hub.

Internationally, we see continued investment into Africa and a good amount of activity in the private equity space across various sectors. Mauritius is often the platform used to facilitate these investments, so we are seeing numerous activities in this space. On the other hand, the commodity cycle seems to be turning and investment in mining and gas explorations is picking up particularly in countries like Mozambique. India continues to have a large amount of activity and remains one of the highest growth countries in the world with important stabilisation coming to some sectors such as steel.

3. The strategy of the bank is in its name? How successful this strategy has been so far?

Since inception, AfrAsia has taken the lead to truly establish a diverse and long-term service in line with pursuing an ‘audacious’ strategy to tap into the growing trade, investment and capital flows between Africa and Asia, leveraging on the many advantages of the Mauritius IFC. Today, with clients in more than 120 countries, we strongly believe that we’ve been able to bring our own unique perspectives and commitments to the market. With our core brand essence, “bank different”, we have always worked towards ensuring that our strategy is aligned to be a ‘different’ bank in the industry, that is, a challenger organisation.

We always make sure that our customers have had an enriched and seamless experience with the bank, one which is niche and customised to their needs, and to a large extent personalised and built on trust. AfrAsia continues to deliver fantastic results and has one of the highest growth rates in the industry.

4. Where do you see the opportunities for Mauritius?

Having long been the tried and trusted investment route, Mauritius is considered as one of the most stable countries in Africa, boasting a very good business environment and well poised to be the financial gateway to the African continent. And a large part of this success is the relatively speaking successful interplay between the government and private sector businesses.

There must be a continuous focus on developing this relationship further and be a model for countries in Africa as to how collaborative efforts between the public and private sector can generate thriving results, long-term growth and sustainability. Mauritius must find new ways to attract FDI and deliver a viable platform for investment into emerging markets. Part of the answer to this lies in developing niche offerings to international markets relevant to the region, for example, can Mauritius develop a viable stock exchange to the Africa mining industry?

Stories

-

Expert views

August 14, 2024

Mauritius as a gateway for investment and transfer of capacity to Africa.

Expert views

August 14, 2024

Mauritius as a gateway for investment and transfer of capacity to Africa.

-

Expert views

July 26, 2024

We have seen a marked increase in initiatives aimed at supporting women’s entry and advancement in the finance industry.

Expert views

July 26, 2024

We have seen a marked increase in initiatives aimed at supporting women’s entry and advancement in the finance industry.

-

Expert views

June 11, 2024

With Africa’s projected continued growth, a robust banking network is crucial.

Expert views

June 11, 2024

With Africa’s projected continued growth, a robust banking network is crucial.

-

Expert views

March 15, 2024

Tailored Financial Excellence: Mauritius’ Unique Investor Advantages

Expert views

March 15, 2024

Tailored Financial Excellence: Mauritius’ Unique Investor Advantages

-

Expert views

May 11, 2023

Banking on sustainable finance to scale up the Mauritius IFC

Expert views

May 11, 2023

Banking on sustainable finance to scale up the Mauritius IFC

-

Expert views

May 10, 2023

Mauritius & South Africa: A mutually beneficial trade relationship

Expert views

May 10, 2023

Mauritius & South Africa: A mutually beneficial trade relationship

-

Expert views

April 17, 2023

Mauritius IFC: From a conventional jurisdiction to a forward-looking hub

Expert views

April 17, 2023

Mauritius IFC: From a conventional jurisdiction to a forward-looking hub

-

Golf

December 18, 2022

Record win for Rozner in AfrAsia Bank Mauritius Open

Golf

December 18, 2022

Record win for Rozner in AfrAsia Bank Mauritius Open

-

Golf

December 17, 2022

Rozner chasing AfrAsia Bank Mauritius Open glory

Golf

December 17, 2022

Rozner chasing AfrAsia Bank Mauritius Open glory

-

Golf

December 16, 2022

Rozner in the hunt again at AfrAsia Bank Mauritius Open

Golf

December 16, 2022

Rozner in the hunt again at AfrAsia Bank Mauritius Open

-

Golf

December 15, 2022

Course record for Välimäki to lead AfrAsia Bank Mauritius Open

Golf

December 15, 2022

Course record for Välimäki to lead AfrAsia Bank Mauritius Open

-

Expert views

December 01, 2022

Africa’s Drive Towards Sustainability: Launch of ESG GPS in Mauritius

Expert views

December 01, 2022

Africa’s Drive Towards Sustainability: Launch of ESG GPS in Mauritius

-

Expert views

October 20, 2022

Quelle est l'influence des taux d'intérêt sur le prix de l'or?

Expert views

October 20, 2022

Quelle est l'influence des taux d'intérêt sur le prix de l'or?

-

Golf

October 18, 2022

Mont Choisy Le Golf set to impress as host of 2022 AfrAsia Bank Mauritius Open

Golf

October 18, 2022

Mont Choisy Le Golf set to impress as host of 2022 AfrAsia Bank Mauritius Open

-

Golf

September 16, 2022

Burmester confirmed for 2022 AfrAsia Bank Mauritius Open

Golf

September 16, 2022

Burmester confirmed for 2022 AfrAsia Bank Mauritius Open

-

Expert views

July 28, 2022

EUR/USD – la roupie prise en étau

Expert views

July 28, 2022

EUR/USD – la roupie prise en étau

-

Expert views

June 01, 2022

Africa CEO Forum 2022 - Malachy McAllister on CNBC Africa

Expert views

June 01, 2022

Africa CEO Forum 2022 - Malachy McAllister on CNBC Africa

-

Events & Webinar

May 12, 2022

Business Presentation – Work, Live and Invest in Mauritius

Events & Webinar

May 12, 2022

Business Presentation – Work, Live and Invest in Mauritius

-

Differentiate. Inspire. Celebrate

April 29, 2022

AfrAsia Bank further sharpens its expertise with Elliott Wave Certification

Differentiate. Inspire. Celebrate

April 29, 2022

AfrAsia Bank further sharpens its expertise with Elliott Wave Certification

-

Expert views

March 04, 2022

Journée des droits des femmes: STOP aux freins invisibles

Expert views

March 04, 2022

Journée des droits des femmes: STOP aux freins invisibles

-

Expert views

March 04, 2022

The real opportunity and uniqueness of Mauritius lies in its diversified economic landscape with opportunities in various sectors.

Expert views

March 04, 2022

The real opportunity and uniqueness of Mauritius lies in its diversified economic landscape with opportunities in various sectors.

-

Expert views

March 02, 2022

La crise Russie-Ukraine : Quels sont les enjeux financiers à prévoir ?

Expert views

March 02, 2022

La crise Russie-Ukraine : Quels sont les enjeux financiers à prévoir ?

-

Testimonials

February 08, 2022

'AfrAsia Bank has always been a trusted financial partner for us.'

Testimonials

February 08, 2022

'AfrAsia Bank has always been a trusted financial partner for us.'

-

Testimonials

February 08, 2022

“ Their legacy-building ethos and customer service structure resonates with us.”

Testimonials

February 08, 2022

“ Their legacy-building ethos and customer service structure resonates with us.”

-

Expert views

January 19, 2022

Preserving the human touch in banking in the digital age

Expert views

January 19, 2022

Preserving the human touch in banking in the digital age

-

Expert views

November 22, 2021

Mauritius is back in business – What to expect for the Tourism/Hospitality and Real Estate sectors?

Expert views

November 22, 2021

Mauritius is back in business – What to expect for the Tourism/Hospitality and Real Estate sectors?

-

Expert views

November 22, 2021

A new era for the Mauritius IFC

Expert views

November 22, 2021

A new era for the Mauritius IFC

-

Expert views

November 22, 2021

A Purposeful Brand - It's not about 'I', it's about 'We'

Expert views

November 22, 2021

A Purposeful Brand - It's not about 'I', it's about 'We'

-

Expert views

November 03, 2021

Quels sont les enjeux pour la Bourse de Maurice avec l’arrivée du Cape Town Stock Exchange ?

Expert views

November 03, 2021

Quels sont les enjeux pour la Bourse de Maurice avec l’arrivée du Cape Town Stock Exchange ?

-

Expert views

October 20, 2021

#Stagflation : Comment s’adapter à cet nouvel ordre économique ?

Expert views

October 20, 2021

#Stagflation : Comment s’adapter à cet nouvel ordre économique ?

-

Expert views

October 20, 2021

Fonds d’investissements : Est-ce le moment d’investir ?

Expert views

October 20, 2021

Fonds d’investissements : Est-ce le moment d’investir ?

-

Expert views

October 18, 2021

Marché des changes: Quel est l’impact sur nos réserves en devises étrangères ?

Expert views

October 18, 2021

Marché des changes: Quel est l’impact sur nos réserves en devises étrangères ?

-

Expert views

September 15, 2021

« Le marché de la banque privée est amené a plus que doubler au cours des cinq prochaines années »

Expert views

September 15, 2021

« Le marché de la banque privée est amené a plus que doubler au cours des cinq prochaines années »

-

Expert views

September 01, 2021

Rather than a purely government or business matter, country branding is more of a concerted and integrated effort made by all stakeholders, including the population.

Expert views

September 01, 2021

Rather than a purely government or business matter, country branding is more of a concerted and integrated effort made by all stakeholders, including the population.

-

Expert views

August 11, 2021

More activities expected between India and Africa via Mauritius

Expert views

August 11, 2021

More activities expected between India and Africa via Mauritius

-

Expert views

August 04, 2021

Repo Rate à 1.85% - Maintenir la tendance baissière des 5 dernières années ou pas ?

Expert views

August 04, 2021

Repo Rate à 1.85% - Maintenir la tendance baissière des 5 dernières années ou pas ?

-

Expert views

August 01, 2021

What is a Structured Product?

Expert views

August 01, 2021

What is a Structured Product?

-

Expert views

July 14, 2021

Global Battery Market powered by Automotive Electrification - Structured Product

Expert views

July 14, 2021

Global Battery Market powered by Automotive Electrification - Structured Product

-

Expert views

July 13, 2021

Deepening our Expertise to serve you better

Expert views

July 13, 2021

Deepening our Expertise to serve you better

-

Expert views

July 12, 2021

Meet our new Head of Sustainability and CSR, Alvin Peerthy

Expert views

July 12, 2021

Meet our new Head of Sustainability and CSR, Alvin Peerthy

-

Expert views

July 05, 2021

The Mauritian Rupee faces the COVID-19 brunt

Expert views

July 05, 2021

The Mauritian Rupee faces the COVID-19 brunt

-

Events & Webinar

June 30, 2021

#Webinar Replay: Cross-border opportunities and challenges in Africa

Events & Webinar

June 30, 2021

#Webinar Replay: Cross-border opportunities and challenges in Africa

-

Events & Webinar

June 14, 2021

20 Min with AfrAsia Webinar - Digital Transformation to build a Sustainable Business

Events & Webinar

June 14, 2021

20 Min with AfrAsia Webinar - Digital Transformation to build a Sustainable Business

-

Expert views

June 09, 2021

Millionaires in Africa: an attractive market for Mauritius

Expert views

June 09, 2021

Millionaires in Africa: an attractive market for Mauritius

-

Expert views

June 07, 2021

La charge est-elle équitablement partagée entre l’Étate et le privé?

Expert views

June 07, 2021

La charge est-elle équitablement partagée entre l’Étate et le privé?

-

Expert views

May 26, 2021

The revival of the UK-Mauritius trade together with the tourism sector could generate more revenue and appreciate the Mauritian rupee

Expert views

May 26, 2021

The revival of the UK-Mauritius trade together with the tourism sector could generate more revenue and appreciate the Mauritian rupee

-

Expert views

May 21, 2021

Tant que nos frontières restent fermées, cette pénurie devrait se poursuivre dans le proche avenir.

Expert views

May 21, 2021

Tant que nos frontières restent fermées, cette pénurie devrait se poursuivre dans le proche avenir.

-

Events & Webinar

May 21, 2021

Retour sur notre #webinaire : Gestion de patrimoine - Post COVID

Events & Webinar

May 21, 2021

Retour sur notre #webinaire : Gestion de patrimoine - Post COVID

-

Expert views

May 19, 2021

Local customers represent 70% of these assets.

Expert views

May 19, 2021

Local customers represent 70% of these assets.

-

Expert views

May 13, 2021

Global vaccination campaign, Inflation and Financial Assets – let’s talk!

Expert views

May 13, 2021

Global vaccination campaign, Inflation and Financial Assets – let’s talk!

-

Expert views

May 12, 2021

Automotive Electrification and the Global Battery Market – are Nickel, Copper and Aluminium your next investment opportunity?

Expert views

May 12, 2021

Automotive Electrification and the Global Battery Market – are Nickel, Copper and Aluminium your next investment opportunity?

-

Expert views

May 11, 2021

Cybersecurity Awakening

Expert views

May 11, 2021

Cybersecurity Awakening

-

Events & Webinar

April 07, 2021

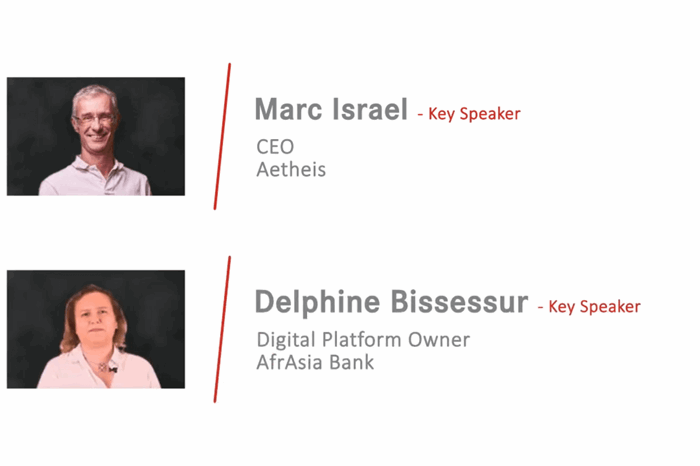

How Mauritius remains a relevant IFC for South African Corporates & Individuals?

Events & Webinar

April 07, 2021

How Mauritius remains a relevant IFC for South African Corporates & Individuals?

-

Expert views

March 24, 2021

Marc-Alexandre Masnin, Directeur des investissements - Business Magazine

Expert views

March 24, 2021

Marc-Alexandre Masnin, Directeur des investissements - Business Magazine

-

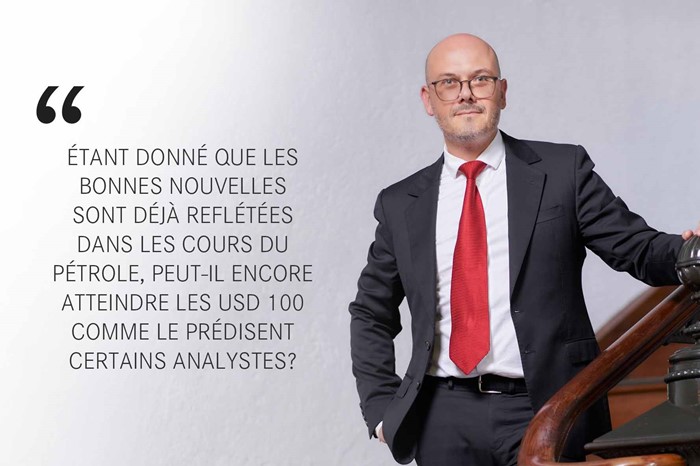

Expert views

March 24, 2021

At the height of the crisis last year, the price of the oil barrel turned negative. However, it hovers today above 60 dollars. Is this a show of confidence in a faster economic recovery?

Expert views

March 24, 2021

At the height of the crisis last year, the price of the oil barrel turned negative. However, it hovers today above 60 dollars. Is this a show of confidence in a faster economic recovery?

-

Community

March 18, 2021

#InternationalWomensDay: Do you Choose to Challenge?

Community

March 18, 2021

#InternationalWomensDay: Do you Choose to Challenge?

-

Expert views

March 17, 2021

L’économie mauricienne peut-elle survivre à un deuxième confinement ?

Expert views

March 17, 2021

L’économie mauricienne peut-elle survivre à un deuxième confinement ?

-

Community

March 08, 2021

#InternationalWomensDay: Do you Choose to Challenge?

Community

March 08, 2021

#InternationalWomensDay: Do you Choose to Challenge?

-

The Believers in Local

February 16, 2021

#AfrAsiaBankLocalMarket – Chinese New Year & Valentine’s Day

The Believers in Local

February 16, 2021

#AfrAsiaBankLocalMarket – Chinese New Year & Valentine’s Day

-

Expert views

February 11, 2021

Interview with Robin Smither, Senior Executive, Head of Corporate Banking, AfrAsia Bank

Expert views

February 11, 2021

Interview with Robin Smither, Senior Executive, Head of Corporate Banking, AfrAsia Bank

-

Expert views

February 03, 2021

Jolene Li Sing How, one of the very first Certified Elliott Wave Analysts

Expert views

February 03, 2021

Jolene Li Sing How, one of the very first Certified Elliott Wave Analysts

-

Expert views

January 20, 2021

AfrAsia was awarded two distinctions by Elliott Wave International.

Expert views

January 20, 2021

AfrAsia was awarded two distinctions by Elliott Wave International.

-

The Believers in Local

December 23, 2020

The believers in local - Christmas Market

The Believers in Local

December 23, 2020

The believers in local - Christmas Market

-

Expert views

December 16, 2020

Mauritius on the EU Black List, what impact since October 1st, 2020?

Expert views

December 16, 2020

Mauritius on the EU Black List, what impact since October 1st, 2020?

-

Expert views

December 14, 2020

Marché des cartes – la dématérialisation enclenchée

Expert views

December 14, 2020

Marché des cartes – la dématérialisation enclenchée

-

Events & Webinar

December 09, 2020

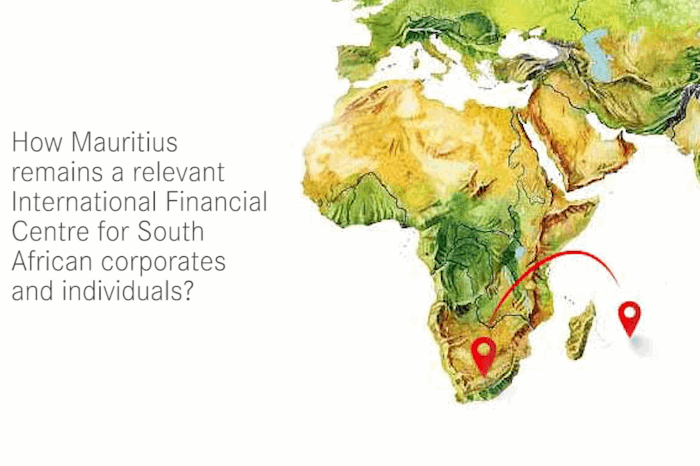

How does Mauritius remain a relevant International Financial Centre for South African corporates and individuals?

Events & Webinar

December 09, 2020

How does Mauritius remain a relevant International Financial Centre for South African corporates and individuals?

-

Expert views

November 18, 2020

«Face aux incertitudes actuelles, privilégier une approche core-satellite»

Expert views

November 18, 2020

«Face aux incertitudes actuelles, privilégier une approche core-satellite»

-

Expert views

November 18, 2020

Nantes Lavin interview on Business Mag

Expert views

November 18, 2020

Nantes Lavin interview on Business Mag

-

Expert views

October 29, 2020

ESG and Responsible Investments – Breaking through to shape a Sustainable World

Expert views

October 29, 2020

ESG and Responsible Investments – Breaking through to shape a Sustainable World

-

Expert views

October 28, 2020

Is Biden winning the forthcoming US Presidential Elections?

Expert views

October 28, 2020

Is Biden winning the forthcoming US Presidential Elections?

-

Expert views

October 27, 2020

Global Wealth Migration Review 2020

Expert views

October 27, 2020

Global Wealth Migration Review 2020

-

Differentiate. Inspire. Celebrate

October 26, 2020

Meet David Chamtyoo, our Elite Achiever of the Year 2019

Differentiate. Inspire. Celebrate

October 26, 2020

Meet David Chamtyoo, our Elite Achiever of the Year 2019

-

The Believers in Local

October 26, 2020

Our very first Local Market

The Believers in Local

October 26, 2020

Our very first Local Market

-

Expert views

October 21, 2020

The best international managers have lost money"

Expert views

October 21, 2020

The best international managers have lost money"

-

Expert views

October 14, 2020

Étant à ce jour «Covid-free», l’île Maurice jouit-elle d’un écosystème robuste pour assurer la protection de vos actifs?

Expert views

October 14, 2020

Étant à ce jour «Covid-free», l’île Maurice jouit-elle d’un écosystème robuste pour assurer la protection de vos actifs?

-

Events & Webinar

October 07, 2020

20 min with AfrAsia - Environment, Social & Governance (ESG) and Responsible Investments

Events & Webinar

October 07, 2020

20 min with AfrAsia - Environment, Social & Governance (ESG) and Responsible Investments

-

Expert views

September 30, 2020

The inclusion of Mauritius on the European Union's blacklist is a considerable hindrance to the image of our international financial center.

Expert views

September 30, 2020

The inclusion of Mauritius on the European Union's blacklist is a considerable hindrance to the image of our international financial center.

-

Events & Webinar

September 24, 2020

Webinar : Foreigners taking up Mauritian Tax Residency – Should they be worried about their Mauritian Trust?

Events & Webinar

September 24, 2020

Webinar : Foreigners taking up Mauritian Tax Residency – Should they be worried about their Mauritian Trust?

-

Expert views

September 21, 2020

Luvna Arnassalon-Seerungen: “Covid-19 has further put sustainability under the corporate spotlight”

Expert views

September 21, 2020

Luvna Arnassalon-Seerungen: “Covid-19 has further put sustainability under the corporate spotlight”

-

Expert views

September 17, 2020

Boosting Mauritius’ reputation as a key enabler of trade

Expert views

September 17, 2020

Boosting Mauritius’ reputation as a key enabler of trade

-

Business & Innovation

September 10, 2020

AfrAsia Customer Survey 2020

Business & Innovation

September 10, 2020

AfrAsia Customer Survey 2020

-

Expert views

September 08, 2020

Le Défi Quotidien : Marc-Alexandre Masnin, Head of Wealth Management- International / Investment Sales, AfrAsia Bank

Expert views

September 08, 2020

Le Défi Quotidien : Marc-Alexandre Masnin, Head of Wealth Management- International / Investment Sales, AfrAsia Bank

-

The Believers in Local

August 21, 2020

Believers in the passion of our entrepreneurs

The Believers in Local

August 21, 2020

Believers in the passion of our entrepreneurs

-

Expert views

August 19, 2020

Rakesh Seesurn, Head of Risk in Business Mag

Expert views

August 19, 2020

Rakesh Seesurn, Head of Risk in Business Mag

-

Expert views

August 18, 2020

Mauritius remains the best gateway for cross-border investments into Africa.

Expert views

August 18, 2020

Mauritius remains the best gateway for cross-border investments into Africa.

-

Events & Webinar

July 27, 2020

20 min with AfrAsia - Mauritius: More than just a property investment.

Events & Webinar

July 27, 2020

20 min with AfrAsia - Mauritius: More than just a property investment.

-

Expert views

July 01, 2020

Impacts of COVID-19 on South African Economy

Expert views

July 01, 2020

Impacts of COVID-19 on South African Economy

-

Expert views

July 01, 2020

Blue economy aims at generating multiple cash-flows from a portfolio of local opportunities

Expert views

July 01, 2020

Blue economy aims at generating multiple cash-flows from a portfolio of local opportunities

-

Community

July 01, 2020

Education remains key to success, even in a different normal

Community

July 01, 2020

Education remains key to success, even in a different normal

-

Expert views

June 29, 2020

EU blacklist: highly prejudicial to the economy

Expert views

June 29, 2020

EU blacklist: highly prejudicial to the economy

-

The Believers in Local

June 22, 2020

Believers in the authenticity of our talents

The Believers in Local

June 22, 2020

Believers in the authenticity of our talents

-

Expert views

June 08, 2020

As businesses undergo digital transformations in their front and back office operations, similarly cybercriminals are advancing the sophistication of their methods.

Expert views

June 08, 2020

As businesses undergo digital transformations in their front and back office operations, similarly cybercriminals are advancing the sophistication of their methods.

-

Expert views

June 06, 2020

The difference in taxation of foreign residents and Mauritian residents in the case of the Solidarity Levy is a first for the country

Expert views

June 06, 2020

The difference in taxation of foreign residents and Mauritian residents in the case of the Solidarity Levy is a first for the country

-

Community

June 01, 2020

Happy Mothers’ and Fathers’ Day!

Community

June 01, 2020

Happy Mothers’ and Fathers’ Day!

-

Expert views

May 21, 2020

Managing credit risks diligently

Expert views

May 21, 2020

Managing credit risks diligently

-

Expert views

May 21, 2020

In our opinion, the most impacted sector of the economy at this stage is the hospitality and tourism industry.

Expert views

May 21, 2020

In our opinion, the most impacted sector of the economy at this stage is the hospitality and tourism industry.

-

Expert views

May 20, 2020

A coordinated response to the impact of the crisis.

Expert views

May 20, 2020

A coordinated response to the impact of the crisis.

-

Expert views

May 08, 2020

COVID-19 - Operational Challenges v/s Technological Opportunities

Expert views

May 08, 2020

COVID-19 - Operational Challenges v/s Technological Opportunities

-

Expert views

May 07, 2020

“Converting the central bank into a magical money tree could lead to a significant currency devaluation”

Expert views

May 07, 2020

“Converting the central bank into a magical money tree could lead to a significant currency devaluation”

-

Expert views

May 06, 2020

“Banks will need to review their internal audit system”

Expert views

May 06, 2020

“Banks will need to review their internal audit system”

-

Expert views

April 27, 2020

Mastering market volatility is a key determinant for investors.

Expert views

April 27, 2020

Mastering market volatility is a key determinant for investors.

-

Expert views

April 22, 2020

Banks have a key role to play in economic recovery

Expert views

April 22, 2020

Banks have a key role to play in economic recovery

-

Expert views

April 20, 2020

Mauritius potentially benefits from a strategic advantage regionally in stimulating a relatively early economic recovery.

Expert views

April 20, 2020

Mauritius potentially benefits from a strategic advantage regionally in stimulating a relatively early economic recovery.

-

Expert views

April 17, 2020

Impact of COVID-19 on Mauritian Economy

Expert views

April 17, 2020

Impact of COVID-19 on Mauritian Economy

-

Expert views

March 13, 2020

Weekly Market Update as at 13 March 2020

Expert views

March 13, 2020

Weekly Market Update as at 13 March 2020

-

Expert views

March 09, 2020

“Gender equality creates the conditions to boost economic development and contributes to economic development”

Expert views

March 09, 2020

“Gender equality creates the conditions to boost economic development and contributes to economic development”

-

Expert views

February 12, 2020

“Brexit and coronavirus will necessarily have an impact on major currencies”

Expert views

February 12, 2020

“Brexit and coronavirus will necessarily have an impact on major currencies”

-

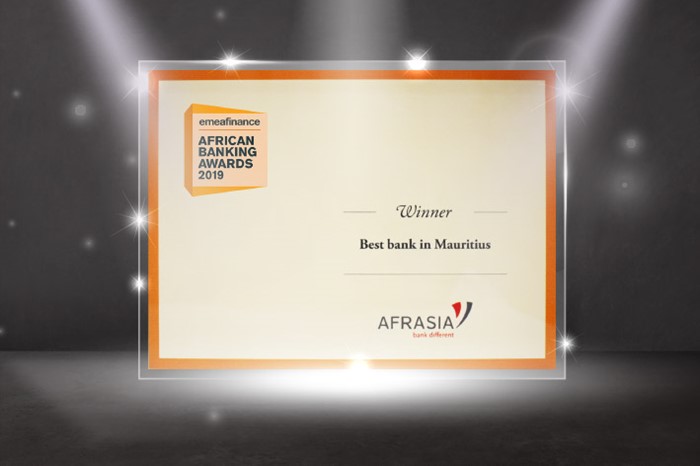

Business & Innovation

February 04, 2020

AfrAsia Bank wins for the third year in a row the Best Bank in Mauritius award

Business & Innovation

February 04, 2020

AfrAsia Bank wins for the third year in a row the Best Bank in Mauritius award

-

Expert views

January 17, 2020

"The contribution of the banking industry and its growth in the financial services sector has been phenomenal"

Expert views

January 17, 2020

"The contribution of the banking industry and its growth in the financial services sector has been phenomenal"

-

Differentiate. Inspire. Celebrate

January 07, 2020

AfrAsia Achiever Awards (AAA)

Differentiate. Inspire. Celebrate

January 07, 2020

AfrAsia Achiever Awards (AAA)

-

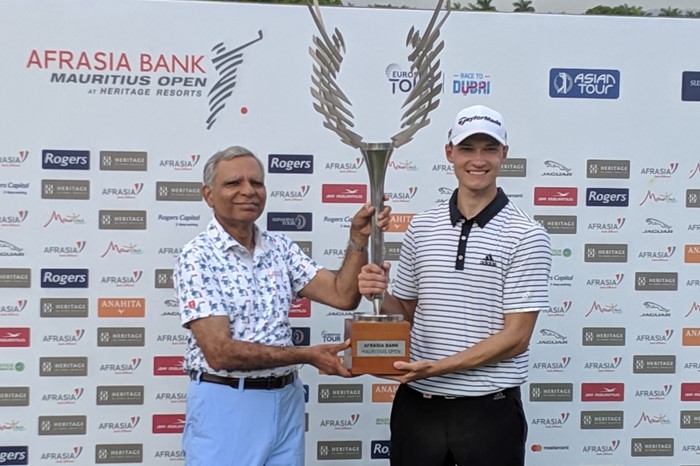

Golf

December 08, 2019

Danish teenager wins AfrAsia Bank Mauritius Open in playoff

Golf

December 08, 2019

Danish teenager wins AfrAsia Bank Mauritius Open in playoff

-

Golf

December 08, 2019

18-year-old claims dream win at AfrAsia Bank Mauritius Open in a playoff

Golf

December 08, 2019

18-year-old claims dream win at AfrAsia Bank Mauritius Open in a playoff

-

Golf

December 07, 2019

Rozner leads French charge in AfrAsia Bank Mauritius Open

Golf

December 07, 2019

Rozner leads French charge in AfrAsia Bank Mauritius Open

-

Golf

December 06, 2019

French golfers poised for historic win in AfrAsia Bank Mauritius Open

Golf

December 06, 2019

French golfers poised for historic win in AfrAsia Bank Mauritius Open

-

Golf

December 05, 2019

Relaxed Stone shares lead in AfrAsia Bank Mauritius Open

Golf

December 05, 2019

Relaxed Stone shares lead in AfrAsia Bank Mauritius Open

-

Golf

December 03, 2019

‘The most beautiful week in golf’ has top players talking

Golf

December 03, 2019

‘The most beautiful week in golf’ has top players talking

-

Testimonials

December 01, 2019

“With the world “slowing down” other jurisdictions are trying hard to challenge us.”

Testimonials

December 01, 2019

“With the world “slowing down” other jurisdictions are trying hard to challenge us.”

-

Business & Innovation

November 30, 2019

''Firms offering wealth services need to continue enhancing the client experience''

Business & Innovation

November 30, 2019

''Firms offering wealth services need to continue enhancing the client experience''

-

Testimonials

November 30, 2019

“We are treated not as customers but as partners”

Testimonials

November 30, 2019

“We are treated not as customers but as partners”

-

Golf

November 25, 2019

Coetzee, Harding, Stone join AfrAsia Bank Mauritius Open field

Golf

November 25, 2019

Coetzee, Harding, Stone join AfrAsia Bank Mauritius Open field

-

Business & Innovation

October 31, 2019

AfrAsia Bank bags two more prestigious international awards

Business & Innovation

October 31, 2019

AfrAsia Bank bags two more prestigious international awards

-

Testimonials

September 30, 2019

“This is really a different Bank where the customer’s well-being matters.”

Testimonials

September 30, 2019

“This is really a different Bank where the customer’s well-being matters.”

-

Testimonials

September 29, 2019

Differentiate. Inspire. Celebrate.

Testimonials

September 29, 2019

Differentiate. Inspire. Celebrate.

-

Expert views

September 28, 2019

"Throughout its history, Mauritius has always been able to re-invent itself in times of hardship."

Expert views

September 28, 2019

"Throughout its history, Mauritius has always been able to re-invent itself in times of hardship."

-

Expert views

September 20, 2019

"Africa is the hinterland for the Mauritian financial services space"

Expert views

September 20, 2019

"Africa is the hinterland for the Mauritian financial services space"

-

Expert views

June 14, 2019

What’s next for Private Wealth?

Expert views

June 14, 2019

What’s next for Private Wealth?

-

Expert views

May 03, 2019

“Internal audit teams should be in a position to express their views at any stage”

Expert views

May 03, 2019

“Internal audit teams should be in a position to express their views at any stage”

-

Expert views

April 24, 2019

"We provide connectivity to HNW South Africans investing offshore"

Expert views

April 24, 2019

"We provide connectivity to HNW South Africans investing offshore"

-

Expert views

April 23, 2019

Thierry Vallet, General Manager, speaks with Mauritius Golf Tours in an exclusive interview

Expert views

April 23, 2019

Thierry Vallet, General Manager, speaks with Mauritius Golf Tours in an exclusive interview

-

Business & Innovation

April 02, 2019

AfrAsia Bank recognised as a pioneer in the Digital HR Space by Oracle

Business & Innovation

April 02, 2019

AfrAsia Bank recognised as a pioneer in the Digital HR Space by Oracle

-

Expert views

March 15, 2019

There is clear visibility towards meaningful growth.

Expert views

March 15, 2019

There is clear visibility towards meaningful growth.

-

Testimonials

March 07, 2019

DIFFERENTIATE. INSPIRE. CELEBRATE by Weekly

Testimonials

March 07, 2019

DIFFERENTIATE. INSPIRE. CELEBRATE by Weekly

-

Testimonials

March 06, 2019

DIFFERENTIATE. INSPIRE. CELEBRATE

Testimonials

March 06, 2019

DIFFERENTIATE. INSPIRE. CELEBRATE

-

Expert views

January 22, 2019

Africa will play a major role in the commercial use of financial technology.

Expert views

January 22, 2019

Africa will play a major role in the commercial use of financial technology.

-

Testimonials

December 13, 2018

Differentiate. Inspire. Celebrate - Weekly

Testimonials

December 13, 2018

Differentiate. Inspire. Celebrate - Weekly

-

Testimonials

December 12, 2018

Differentiate. Inspire. Celebrate - Business Magazine

Testimonials

December 12, 2018

Differentiate. Inspire. Celebrate - Business Magazine

-

Business & Innovation

December 07, 2018

AfrAsia Bank wins 4 awards at the EMEA Finance’s African Banking Awards 2018

Business & Innovation

December 07, 2018

AfrAsia Bank wins 4 awards at the EMEA Finance’s African Banking Awards 2018

-

Golf

December 05, 2018

AfrAsia Bank Mastercard Pro-Am Results

Golf

December 05, 2018

AfrAsia Bank Mastercard Pro-Am Results

-

Golf

December 02, 2018

Kurt kicks on with breakthrough win in AfrAsia Bank Mauritius Open

Golf

December 02, 2018

Kurt kicks on with breakthrough win in AfrAsia Bank Mauritius Open

-

Golf

December 01, 2018

SA's Harding chasing win number five in Mauritius

Golf

December 01, 2018

SA's Harding chasing win number five in Mauritius

-

Golf

November 29, 2018

Els hoping local knowledge gives him the edge in Mauritius

Golf

November 29, 2018

Els hoping local knowledge gives him the edge in Mauritius

-

Testimonials

October 18, 2018

Differentiate. Inspire. Celebrate - Weekly

Testimonials

October 18, 2018

Differentiate. Inspire. Celebrate - Weekly

-

Testimonials

October 17, 2018

Differentiate. Inspire. Celebrate - Business Magazine

Testimonials

October 17, 2018

Differentiate. Inspire. Celebrate - Business Magazine

-

Expert views

October 10, 2018

“An ageing population is also synonymous to declining growth”

Expert views

October 10, 2018

“An ageing population is also synonymous to declining growth”

-

Expert views

September 28, 2018

Weekly Market Update as at 28 September 2018

Expert views

September 28, 2018

Weekly Market Update as at 28 September 2018

-

Expert views

September 26, 2018

Sustainability development is an essential condition to become a high-income country

Expert views

September 26, 2018

Sustainability development is an essential condition to become a high-income country

-

Expert views

September 21, 2018

Weekly Market Update as at 21 September 2018

Expert views

September 21, 2018

Weekly Market Update as at 21 September 2018

-

Expert views

September 07, 2018

Weekly Market Update as at 07 September 2018

Expert views

September 07, 2018

Weekly Market Update as at 07 September 2018

-

Expert views

August 31, 2018

Weekly Market Update as at 08 February 2019

Expert views

August 31, 2018

Weekly Market Update as at 08 February 2019

-

Expert views

August 31, 2018

Weekly Market Update as at 31 August 2018

Expert views

August 31, 2018

Weekly Market Update as at 31 August 2018

-

Expert views

August 24, 2018

Weekly Market Update as at 24 August 2018

Expert views

August 24, 2018

Weekly Market Update as at 24 August 2018

-

Expert views

August 17, 2018

Weekly Market Update as at 17 August 2018

Expert views

August 17, 2018

Weekly Market Update as at 17 August 2018

-

Expert views

August 03, 2018

Weekly Market Update as at 03 August 2018

Expert views

August 03, 2018

Weekly Market Update as at 03 August 2018

-

Expert views

July 27, 2018

Weekly Market Update as at 27 July 2018

Expert views

July 27, 2018

Weekly Market Update as at 27 July 2018

-

Golf

July 21, 2018

Gary Todd bags Pro-Am ticket to the AfrAsia Bank Mauritius Open 2018.

Golf

July 21, 2018

Gary Todd bags Pro-Am ticket to the AfrAsia Bank Mauritius Open 2018.

-

Expert views

July 17, 2018

Sanjiv Bhasin on Global Business sector: “A new market will open up”

Expert views

July 17, 2018

Sanjiv Bhasin on Global Business sector: “A new market will open up”

-

Expert views

July 06, 2018

Weekly Market Update as at 06 July 2018

Expert views

July 06, 2018

Weekly Market Update as at 06 July 2018

-

Golf

June 30, 2018

A spectacular kick-off round for a Pro-Am ticket at the AfrAsia Bank Mauritius Open 2018 at Anahita

Golf

June 30, 2018

A spectacular kick-off round for a Pro-Am ticket at the AfrAsia Bank Mauritius Open 2018 at Anahita

-

Expert views

June 29, 2018

Weekly Market Update as at 29 June 2018

Expert views

June 29, 2018

Weekly Market Update as at 29 June 2018

-

Expert views

June 22, 2018

Weekly Market Update on Radio One as at 22 June 2018

Expert views

June 22, 2018

Weekly Market Update on Radio One as at 22 June 2018

-

Expert views

June 12, 2018

Rethinking private banking

Expert views

June 12, 2018

Rethinking private banking

-

Golf

June 04, 2018

Sanjiv Bhasin, CEO, speaks with Mauritius Golf Tours in an exclusive interview

Golf

June 04, 2018

Sanjiv Bhasin, CEO, speaks with Mauritius Golf Tours in an exclusive interview

-

Business & Innovation

May 17, 2018

AfrAsia wins the Best Corporate Bank 2018 award for the second year in a row

Business & Innovation

May 17, 2018

AfrAsia wins the Best Corporate Bank 2018 award for the second year in a row

-

Expert views

May 15, 2018

'Mauritius has the benefit of being in Africa without being in mainland', says Assad Abdullatiff

Expert views

May 15, 2018

'Mauritius has the benefit of being in Africa without being in mainland', says Assad Abdullatiff

-

Expert views

May 15, 2018

IFRS9 - What you need to know by Robin Smither

Expert views

May 15, 2018

IFRS9 - What you need to know by Robin Smither

-

Business & Innovation

May 15, 2018

Banking on customer centricity

Business & Innovation

May 15, 2018

Banking on customer centricity

-

Community

May 15, 2018

Supporting the communities where we live and work

Community

May 15, 2018

Supporting the communities where we live and work

-

Events & Webinar

May 15, 2018

AfrAsia Bank Roadshow: Johannesburg business elites under one roof

Events & Webinar

May 15, 2018

AfrAsia Bank Roadshow: Johannesburg business elites under one roof

-

Events & Webinar

May 15, 2018

AfrAsia Bank Real Estate Seminar: The property investment hotspots revealed

Events & Webinar

May 15, 2018

AfrAsia Bank Real Estate Seminar: The property investment hotspots revealed

-

Events & Webinar

May 14, 2018

AfrAsia & SA Chamber of Commerce host futurist expert, Anton Musgrave for thought-provoking experience

Events & Webinar

May 14, 2018

AfrAsia & SA Chamber of Commerce host futurist expert, Anton Musgrave for thought-provoking experience

-

Business & Innovation

January 01, 0001

A clientele made up of 70% foreigners

Business & Innovation

January 01, 0001

A clientele made up of 70% foreigners