A landmark shift for the global financial industry

The transition away from the World’s most dominant reference rate LIBOR is a global event arising from the significant reforms led by central banks and regulatory authorities to improve the robustness and integrity of financial benchmarks. With more than USD300 trillion in outstanding financial contracts that reference LIBOR, this transition is likely to cause significant legal, valuation, accounting, risk management, and system implications for banks globally. Therefore, there is an urgent call for the financial industry to accelerate the preparation for the transition away from LIBOR by the deadline of 31 December 2021.

What is LIBOR?

The London Interbank Offered Rate (LIBOR) is the most widely used benchmark for short–term interest rates and is used as the reference rate for derivatives, bonds, business loans and other financial products. The setting of LIBOR is made daily by submissions of indications of the average rates at which LIBOR panel banks can borrow from other banks on an unsecured basis in five (5) currencies (USD, GBP, EUR, JPY and CHF).

Why LIBOR is being phased out and when?

In the aftermath of the global financial crisis of 2007/08, there were widespread allegations of LIBOR manipulation resulting in significant fines being imposed on several international banks and a general loss of confidence amongst market participants in the accuracy and reliability of LIBOR.

What are the implications on financial markets of LIBOR phasing out?

Given the quantum of financial products that use LIBOR, its phasing out comes with significant impact on all participants in financial and capital markets globally.

What are the replacement benchmarks?

Regulators, financial institutions and industry working groups are continuing to take various measures to perform this transition within set deadlines. Whilst subject to further review and change, the following are being discussed in the market as being proposed replacement rates for the corresponding currencies:

Frequently Asked Questions

Read More

#𝐖𝐞𝐛𝐢𝐧𝐚𝐫 𝐑𝐞𝐩𝐥𝐚𝐲

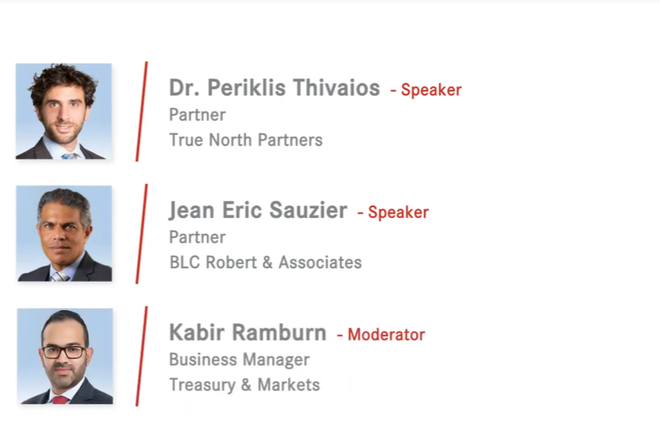

As the 2021 deadline for pulling the plug on LIBOR (London Interbank Offered Rate) approaches, transitioning to alternative reference rates represents is a critical and complex challenge for banks and financial institutions. Check out our full webinar replay video to know the ins and outs of this global changeover

Progress Updates

IBOR enters final chapter as financial markets worldwide prepares for a massive and historic change. With the end of 2021 getting ever nearer, we would like to share some of the key highlights, achievements and issues encountered as AfrAsia gets ready for a IBOR-less era.

Our IBOR Transition programme is overseen by the IBOR Transition Steering Committee comprising of senior personnel which meets on a monthly basis highlighting the importance of the Programme to the Bank.