Change your life today. Don't gamble on the future, act now, without delay.

USD

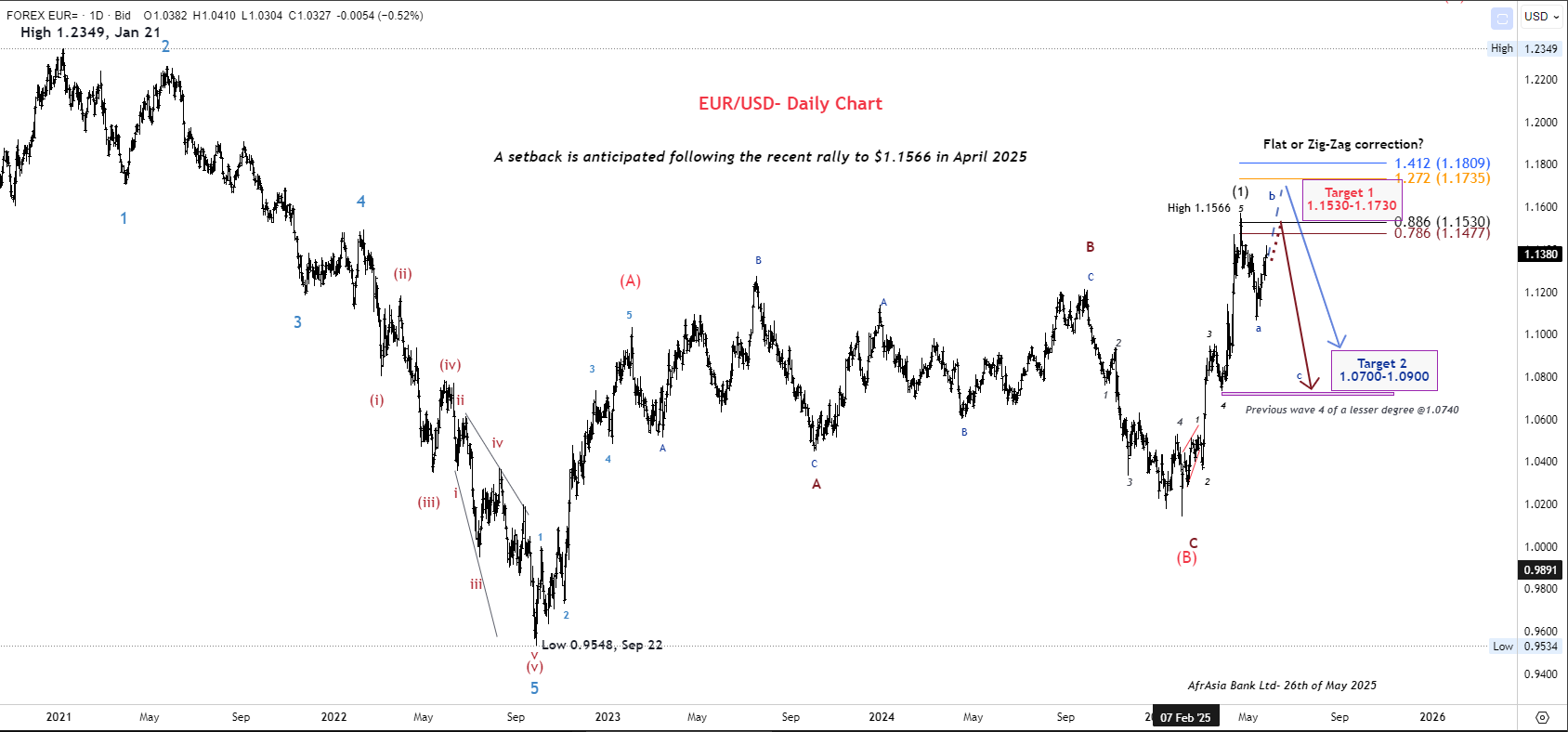

EUR/USD

The Single currency licked its wounds at $1.1778 after slipping to $1.1718 as U.S. Unemployment Rate fell short of expectations, therefore bolstering the Federal Reserve's case for not rushing for a rate cut.

GBP/USD

The Pound Sterling recovered to $1.3670 on signs of easing political turmoil following UK's Prime Minister Keir Starmer open support for Chancellor Rachel Reeves, stating that she would remain in her role "for a very long time".

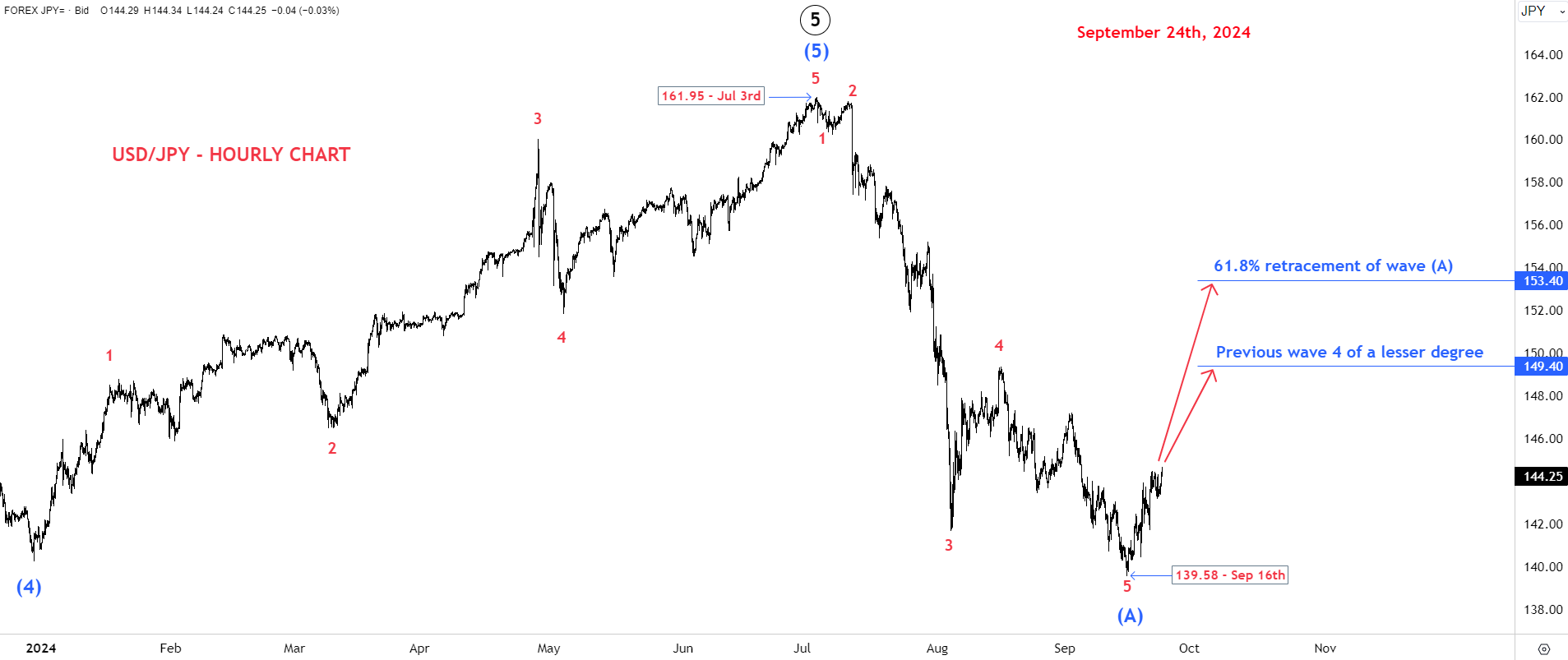

USD/JPY

The Japanese Yen lost further ground at 144.35 against the greenback. undermined by worries that the global trade tensions could act as a headwind for the Bank of Japan's plan to normalize interest rates.

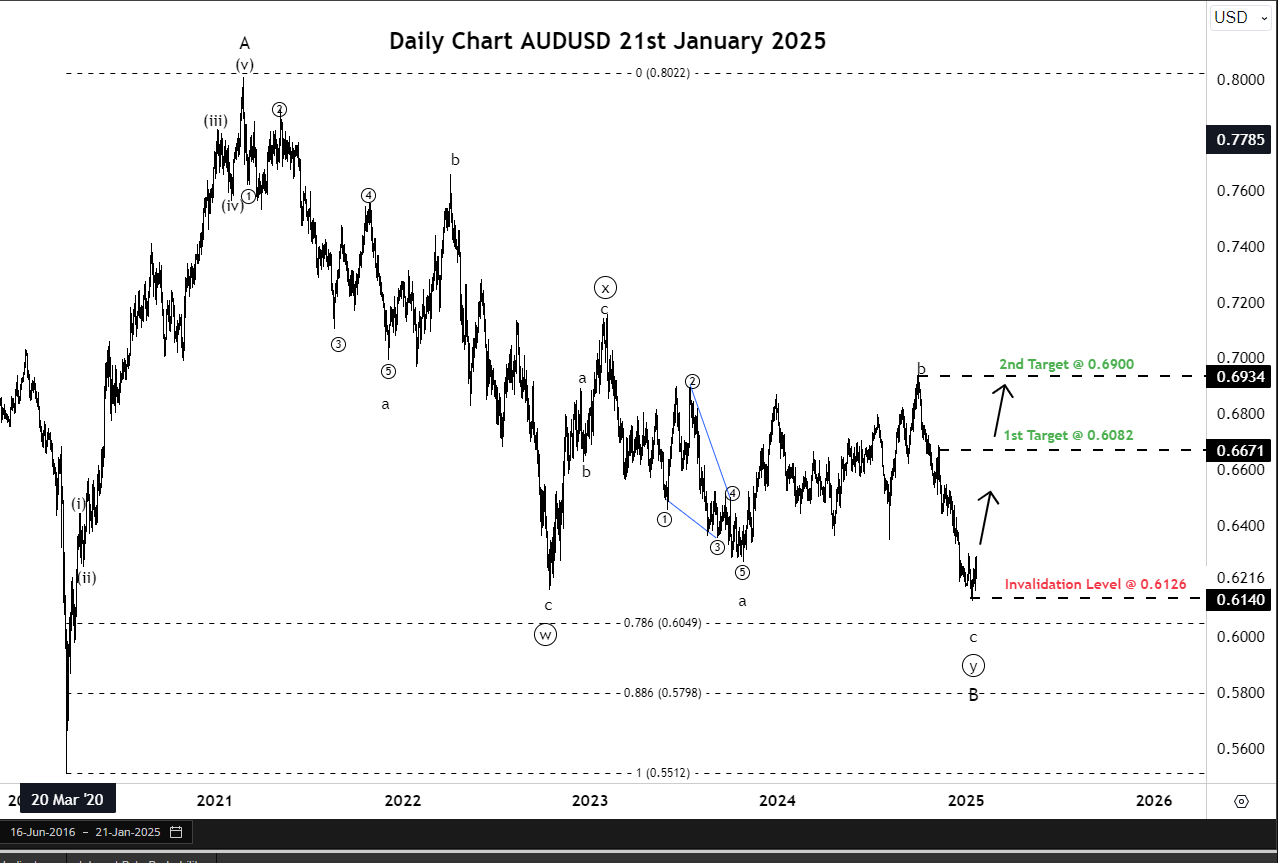

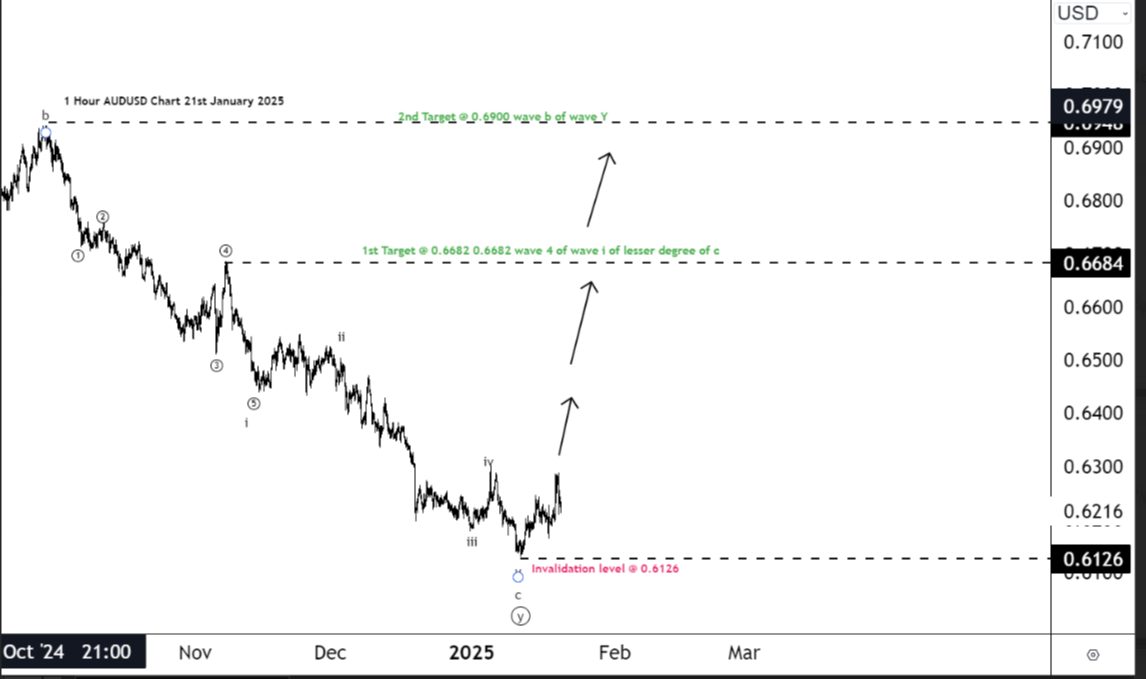

AUD/USD

The Australian dollar crawled higher at $0.6572, unfazed by the Chinese Commerce Ministry's statement detailing how the U.S. and China are loosening their trade war measures.

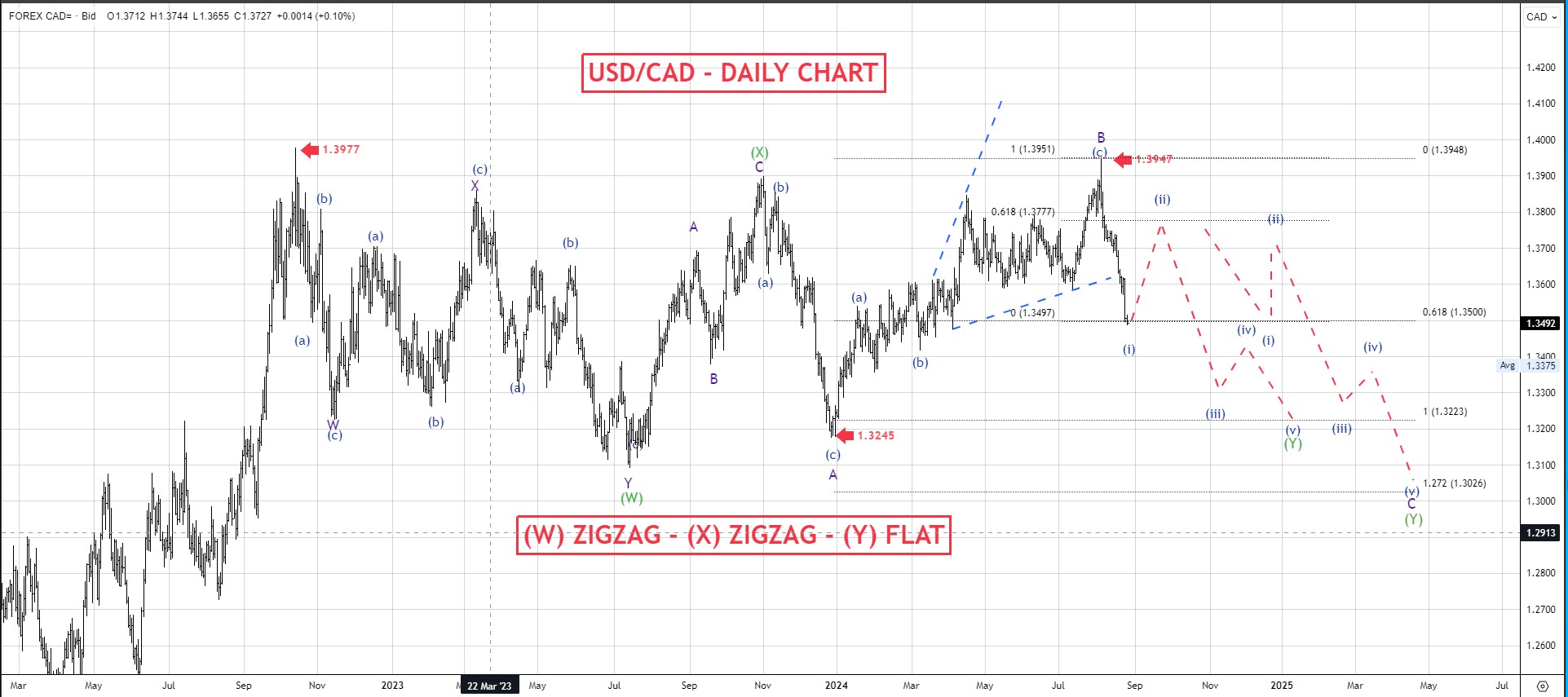

USD/CAD

The Canadian Dollar gained to 1.3570 against the U.S. Dollar despite a scanty domestic economic calendar.

USD/ZAR

The Rand appreciated to 17.48 on U.S. Dollar weakness.

USD/MUR

The U.S. dollar progressed to 45.42(selling) against the rupee this morning.

10:00 EUR German Factory Orders

12:00 EUR ECB Elderson speech

13:00 EUR Producer Price Index

19:00 GBP BoE Taylor speech